“With good judgment,little else matters. Without it, nothing else matters.”

The GOD Delusion

A Deeply Religious Non Believer… Why there almost certainly is no God

Vedanta Ltd May 15, 2020

Vedanta Ltd

Price: Rs 92.95

FV: Rs 1

MCAP: Rs 34514 Crs

52 W High: Rs 179.95

52 W Low: Rs 60.3

Financials:

All figures in Rs Cr. except for BV and EPS

| 15/05/2020 | Vedanta Ltd | |||||||||

| Year | Equity Capital | Net Worth | Long Term Debt | Total Sales | PAT | BV | EPS | P/E | P/BV | Promoter’s Holdings |

| Rs Cr. | Rs Cr. | Rs Cr. | Rs Cr. | Rs Cr. | Rs | Rs | % | |||

| 2019/20 9m | 372 | 73385 | 46561 | 66575 | 7339 | 197.27 | 19.73 | 3.53 | 0.47 | 50.14 |

| 2018/19 | 372 | 62297 | 57703 | 96066 | 9698 | 167.47 | 26.07 | 3.57 | 0.56 | 50.14 |

Vedanta Limited, formerly known as Sesa Sterlite/Sesa Goa Limited, is a mining company based in India, with its main operations in iron ore, gold and Aluminium mines in Goa, Karnataka, Rajasthan and Odisha.

Mr. Anil Agarwal is the Chairman of the company.

Segment Revenue Breakup:

All figures in Rs Cr unless specified

| Head | 9m 2020 | 2019 | |

| India | Zinc and Lead | 12023 | 18088 |

| Silver | 1843 | 2568 | |

| International | Zinc | 2395 | 2738 |

| Oil and Gas | 10257 | 13223 | |

| Aluminium | 20199 | 29229 | |

| Copper | 6797 | 10739 | |

| Iron Ore | 2390 | 2911 | |

| Power | 4656 | 6524 | |

| Others | 3558 | 5023 | |

| Less Inter Segment Transfers | -86 | -142 | |

| Revenue from Operations | 64032 | 90901 |

Equity History:

| Year | No. of shares | |

| 2001 | 100 | |

| 2005 | 200 | Bonus issue of 1:1, 16/2/2005 |

| 2008 | 400 | Bonus issue of 1:1, 8/8/2008 |

| 2008 | 4000 | Split from 10 to 1, 8/8/2008 |

Major Domestic Investors:

| Shareholders | % Held |

| LIC | 6.4 |

| ICICI Prudential | 5 |

| HDFC Infrastructure Fund | 2.5 |

| SBI Arbitrarge Fund | 1.1 |

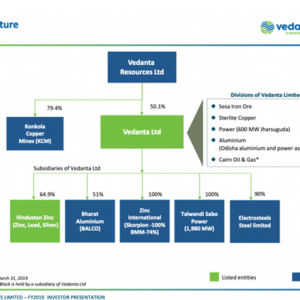

Group Structure:

The zinc business under its subsidiary HZL remains the highest cash-generating business.

Buyback:

The company plans to delist itself from the stock exchanges and in turn become private. (https://www.bseindia.com/xml-data/corpfiling/AttachHis/d8db546e-c273-45bb-91e7-7d27181f847b.pdf)

The Indicative price which is the floor price is quoted at Rs. 87.5 per share to buyout the 49% of the holdings which will fetch Rs 16200 crs (185 crs shares * Rs. 87.5) mainly to repay debt in the medium term and for corporate simplification purpose. Delisting will provide enhanced operational and financial flexibility.

The buyback is supposed to be carried out by a process of reverse book building.

The final price will be decided by the merchant bankers (Reverse book building process) if there is no voting for delisting of more than 75% and it will go in the second tranche of process.

The current debt is $7 billion with $1.9 billion maturing in the next 12-15 months.

Experts believe that it is company’s move to lap up the shares at such a low cost from the minority shareholders.

Vedanta Resources’ inefficient corporate structure and dependence on dividends from Vedanta Ltd for debt servicing have constrained its credit profile

A successful privatization of Vedanta would improve Vedanta Resources’ access to the subsidiary’s cash flows. This will be due to more efficient dividend upstreaming (compared to about 50 per cent that is currently paid to minority shareholders).

The stock is available at 50% of the 52 week high, hence this would be a perfect opportunity for Anil Agarwal to exercise the buyback. The Board of directors have decided to meet on the 18th of May to consider the offer.

Vedanta wants to delist at cyclical lows, but investors may not budge. (https://www.livemint.com/market/mark-to-market/vedanta-wants-to-delist-at-cyclical-lows-but-investors-may-not-budge-11589471491854.html)

Daily Notifications as on 15th May, 2020

https://www.bseindia.com/markets/MarketInfo/DispNewNoticesCirculars.aspx?page=20200515-39

1. Scrip code : 532424

Name : Godrej Consumer Products Ltd.

Subject : Announcement under Regulation 30 (LODR)-Acquisition

The Exchanges are hereby informed that the Company through its wholly owned subsidiary, has acquired balance 25% stake in Canon Chemicals Limited. The Company had earlier acquired 75% stake in Canon Chemicals Limited, Kenya through Godrej East Africa Holdings Limited, a wholly owned subsidiary in 2016. As per the agreement entered into with the sellers, the Company has now acquired the balance 25% stake on May 15, 2020. Details as required pursuant to Regulation 30 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 are enclosed herewith.

2. Scrip code : 500164

Name : Godrej Industries Ltd.

Subject : Announcement under Regulation 30 (LODR)-Scheme of Arrangement

Further to the announcement made by the Company on April 23, 2020 regarding sanctioning of the Scheme by the Hon’ble National Company Law Tribunal, Mumbai Bench on April 22, 2020, we wish to inform you that the Scheme has become effective post filing of e-Form INC-28 by the Company on May 14, 2020 with the Registrar of Companies, Mumbai / Ministry of Corporate Affairs. Kindly take the above on your record.

Daily Notifications as on 14th May, 2020

https://www.bseindia.com/markets/MarketInfo/DispNewNoticesCirculars.aspx?page=20200514-24

1. Scrip code : 504341

Name : RAVINDRA ENERGY LIMITED

Subject : Outcome Of The Board Meeting

The Board of Directors of the Company at its meeting held on Thursday, May 14, 2020 inter alia considered and approved the draft Scheme of Amalgamation of Agri Venture Trading and Investment Private Limited, a Wholly-Owned Subsidiary, into Ravindra Energy Limited, the Holding Company, under sections 230 to 232 of the Companies Act, 2013. Copy of the Scheme of Amalgamation, pursuant to the proviso to Regulation 37(6) of the SEBI (Listing Obligation and Disclosure Requirements) Regulations, 2015, is enclosed herewith for the purpose of disclosure.

2. Scrip code : 522289

Name : NMS RESOURCES GLOBAL LIMITED

Subject : Announcement under Regulation 30 (LODR)-Acquisition

The Board has considered and approved the proposal for investment/acquisitions of Equity Shares by way of purchase, conversion or otherwise Equity Shares, One Public Company to the extent make them ‘Wholly Owned Subsidiary’ of NMS Resources Global Limited (Formerly ‘IFM Impex Global Limited’) i.e. NMS Enterprises Limited w.e.f. 1st April, 2020,that NMS Resources Global Limited will issue shares in lieu of consideration as per the valuation report provided the Merchant Banker to be appointed, to expand the business of the Company by pooling the available resources and obtaining the advantage by Economic of Scale, Availability of Better Resources, Expanded Client Base, Wider business Opportunities, Creating the ‘Synergy Effect’. Such investment by the Company is within the scope and limit as prescribed under section 186 of the Companies Act, 2013, subject to approval of concern authorities or parties.

3. Scrip code : 540725

Name : Share India Securities Limited

Subject : Announcement under Regulation 30 (LODR)-Acquisition

Pursuant to Regulation 30 of the SEBI (LODR) Regulations, 2015, we hereby inform you that the Board of Directors at their meeting held on Wednesday, 13th May 2020 have decided to purchase 100% Equity Shares of M/s. Total Commodities (India) Private Limited, subject to compliance with all applicable laws and requisite approvals, if any. Consequently M/s.Total Commodities (India) Private Limited will become a Wholly-Owned Subsidiary of the Company.

Daily Notifications as on 13th May, 2020

https://www.bseindia.com/markets/MarketInfo/DispNewNoticesCirculars.aspx?page=20200513-28

1. Scrip code : 533400

Name : Future Consumer Limited

Subject : Board to consider Rights Issue of equity shares

Future Consumer Ltd has informed BSE that a meeting of the Board of Directors of the Company will be held on May 16, 2020.

2. Scrip code : 542726

Name : IndiaMART InterMESH Limited

Subject : Announcement under Regulation 30 (LODR)-Acquisition

This disclosure is given under Regulation 30 read with Schedule III of SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 that Indiamart Intermesh Limited has entered into an agreement to invest in Mobisy Technologies Private Limited.

Daily Notifications as on 12th May, 2020

https://www.bseindia.com/markets/MarketInfo/DispNewNoticesCirculars.aspx?page=20200512-31

1. Scrip code : 542337

Name : Spencer’s Retail Limited

Subject : Outcome Of The Meeting Of The Board Of Directors Of Spencer’S Retail Limited (‘Company’)

This is in furtherance to our intimation dated February 11, 2020 in relation to the proposed rights issue of equity shares the Company for an amount not exceeding Rs. 8,000 lakhs in accordance with the Securities and Exchange Board of India (Issue of Capital and Disclosure Requirements) Regulations, 2018, as amended (‘SEBI ICDR Regulations’) and other applicable laws (‘Rights Issue’). We wish to inform that the board of directors of the Company (‘Board’) in its meeting held today, i.e., May 11, 2020, has approved the audited consolidated financial statements of the Company for the period ended December 31, 2019, copy of which is being submitted herewith. The same has been prepared and audited solely for the purposes of restatement in accordance with SEBI ICDR Regulations in relation to the Rights Issue. The above is for your information and dissemination to the members. We request you to kindly take the same on record

2. Scrip code : 539660

Name : BEST AGROLIFE LIMITED

Subject : Announcement under Regulation 30 (LODR)-Scheme of Arrangement

Pursuant to the Regulation 30 of SEBI (Listing Obligation and Disclosure Requirements)Regulations, 2015, this is to inform you that the Hon”ble National Company Law Tribunal, Principle Bench, New Delhi vide its order dated 5 May, 2020 has approved the Scheme of Amalgamation u/s 230 to 232 of the Companies Act, 2013 between of M/s Best Agrochem Private Limited (Transferor Company) and M/s Best Agrolife Limited (Transferee Company), which was received by us on 12 May, 2020. The scheme with appointed date of 1st April, 2018 will be effective upon filing the certified true copy of the order with the Registrar of Companies, Delhi. Kindly take the note of above information on your records and acknowledge the receipt.

3. Scrip code : 524648

Name : Indo Amines Ltd.

Subject : Announcement under Regulation 30 (LODR)-Scheme of Arrangement

Pursuant to Regulation 30(7) of SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015, we are pleased to inform you that Hon”ble National Company Law Tribunal, Mumbai, Principal Bench, vide its order dated April 24, 2020 (”Order”) has approved the Scheme of Amalgamation between Core Chemicals (Mumbai) Private Limited (Transferor Company No. 1” or ”CCMPL”) and Key Organics Private Limited (‘Transferor Company No. 2’ or ‘KOPL’) with Indo Amines Limited (”Transferee Company” or ‘IAL’ or ‘the Company’) and their respective shareholders and creditors under Sections 230 to 232 of the Companies Act, 2013. Further, we would like to inform you that, the Company has received the certified copy of the Order and the same is enclosed and the Company has yet to receive the certified copy of Scheme from the National Company Law Tribunal, Mumbai, Principal Bench. We request you to take the above information on record.

Daily Notifications as on 11th May, 2020

https://www.bseindia.com/markets/MarketInfo/DispNewNoticesCirculars.aspx?page=20200511-31

1. Scrip code : 500325

Name : Reliance Industries Ltd

Subject : ‘Record Date’ For The Purpose Of Rights Issue

We inform you that the Rights Issue Committee constituted by the Board of Directors of the Company has, at its meeting held today, fixed Thursday, May 14, 2020 as the ‘Record Date’ for the purpose of determining the equity shareholders entitled to receive the rights entitlement in the rights issue (‘Eligible Shareholders’). The Company has obtained International Securities Identification Number (ISIN): INE002A20018 for the purpose of credit of the rights entitlements in accordance with the provisions of Regulation 77A of the Securities and Exchange Board of India (Issue of Capital and Disclosure Requirements) Regulations, 2018 read with relevant circulars in this regard issued by Securities and Exchange Board of India from time to time. The rights issue opening and closing dates will be informed separately.

2. Scrip code : 504341

Name : RAVINDRA ENERGY LIMITED

Subject : Board Meeting Intimation for Intimation Of Board Meeting To Consider And Approve The Scheme Of Amalgamation

Ravindra Energy Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 14/05/2020 ,inter alia, to consider and approve Pursuant to SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015, please take notice that a Meeting of the Board of Directors of the Company will be held on Thursday, the 14th day of May 2020, inter alia, to consider and approve the Scheme of Amalgamation of Agri Venture Trading and Investment Private Limited (a Wholly-Owned Subsidiary) in to Ravindra Energy Limited.

3. Scrip code : 532757

Name : VOLTAMP TRANSFORMERS LIMITED

Subject : Announcement under Regulation 30 (LODR)-Scheme of Arrangement

The Board of Directors of the Company have considered and approved a Scheme of Amalgamation (the “Scheme”) between the Voltamp Transformers Limited (“VTL”” or “Company”) and Kunjal Investment Private Limited (“KIPL”), and their respective shareholders and creditors (“Scheme”) under Sections 230 to 232 read with section 66 and other applicable provisions of the Companies Act, 2013 (“2013 Act”).

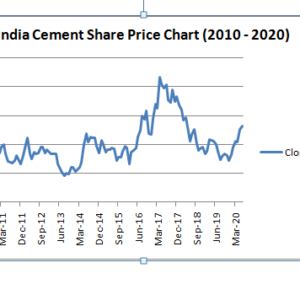

India Cements May 8,2020

India Cements

Cements & Cement Products

FV – Rs 10; 52wks H/L – 140/67.9; TTQ – 3.93 Lacs; C MP – Rs 131.7 (As On May 8, 2020); Market Cap – Rs 4081 Crs

Consolidated Financials and Valuations (Amt in Rs Crs unless specified)

| India Cement | ||||||||||

| Year | Equity Capital | Net Worth | Long Term Debt | Total Sales | PAT | BV | EPS | P/E | P/BV | Promoter’s Holdings |

| Rs Cr. | Rs Cr. | Rs Cr. | Rs Cr. | Rs Cr. | Rs | Rs | % | |||

| 2019/20

(9 Months) |

310 | 5284 | 3125 | 4030 | 65 | 170.50 | 2.10 | 62.58 | 0.77 | 28.26 |

| 2018/19 | 310 | 5246 | 3048 | 5809 | 25 | 169.28 | 0.82 | 161.57 | 0.78 | 28.30 |

Price Chart (2010-2020):

Peer Comparison:

| India Cement (9mo) | Ultratech Cements | Shree Cements | Birla Corporation | |

| Price (Rs) | 131.7 | 3779.75 | 21190.45 | 538.95 |

| FV (Rs) | 10 | 10 | 10 | 10 |

| Market Cap | 4081 | 109093 | 76457 | 4150 |

| Equity | 310 | 289 | 36 | 77 |

| Net Worth | 5349 | 39115 | 13169 | 4806 |

| Total Debt | 3125 | 21353 | 2349 | 3753 |

| Sales | 4030 | 42773 | 13143 | 7001 |

| Net Profit | 65 | 5810 | 1544 | 505 |

| EPS (Rs) | 2.1 | 201.3 | 428.0 | 65.6 |

| BV (Rs) | 172.6 | 1355.2 | 3650.1 | 624.1 |

| PE | 47.1 | 18.8 | 49.5 | 8.2 |

| PB | 0.8 | 2.8 | 5.8 | 0.9 |

| Capacity (MT) | 15.5 | 111.4 | 40.4 | 15.5 |

| Realization Per Tonne | 3650 | 4750 | 4648 | 4712 |

Daily Notifications as on 8th May, 2020

https://www.bseindia.com/markets/MarketInfo/DispNewNoticesCirculars.aspx?page=20200508-27

1. Scrip code : 512529

Name : Sequent Scientific Limited

Subject : Outcome Of Board Meeting

We wish to inform you that some Promoters (detailed in the Annexure below) (collectively referred to as the ‘Sellers’) of SeQuent Scientific Limited (‘SeQuent’) propose to sell their entire Shareholding in SeQuent to CA Harbor Investments, which belongs to the group of entities doing business globally as, ‘The Carlyle Group’, (the ‘Acquirer’) who also intends to acquire control over SeQuent, the foregoing proposed transaction being hereinafter referred to as the ‘Proposed Transaction’. The Board of Directors at their Meeting held today noted and approved the execution, delivery, and performance of the Representations and Warranties Agreement (‘RWA’) to be entered into among the Sellers, the Acquirer, and SeQuent. The Proposed Transaction shall attract an obligation on the Acquirer to make an open offer as required under Regulations 3(1) and 4 of Securities and Exchange Board of India (Substantial Acquisition of Shares and Takeovers), Regulations, 2011 (‘SEBI SAST’).

2. Scrip code : 957846

Name : Reliance Industries Ltd

Subject : Announcement under Regulation 30 (LODR)-Press Release / Media Release

Vista to invest ? 11,367 crore in Jio Platforms at an equity value of ? 4.91 lakh crore