DCM Shriram Ltd

Diversified

FV – Rs 2; 52wks H/L – 537.75/175.8; TTQ – 5133; CMP – Rs 320 (As On July 15, 2020);

Market Cap – Rs 5265 Crs

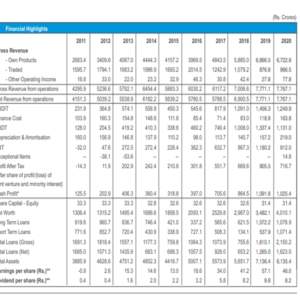

Consolidated Financials and Valuations (Amt in Rs Crs unless specified)

Equity Capital |

Net worth |

Debt | Total Sales |

PAT | BV (Rs) |

EPS (Rs) |

P/E |

Industry P/E |

P/BV |

Promoter’s Stake |

|

| FY20 | 31.35 | 4050 | 2046 | 7870 | 717 | 129 | 45.7 | 7 | 28.61 | 2.5 | 66.53 |

| FY19 | 31.35 | 3526 | 1475 | 7859 | 906 | 225 | 57.8 | 5.5 | 28.61 | 1.4 | 66.53 |

Debt to Equity – 0.5

ROE – 18%

Market Cap/Sales – 0.7

The schedule for implementation of capacity expansion at Bharuch for Caustic Soda Plant by 700 TPD (along with 120 MW Captive Power plant and Flaker capacity expansion of 500 TPD) at an investment of Rs.1070 crs is being realigned taking into account the impact of Covid-19.

Overview:

- DCM Shriram Ltd is a spin-off from the trifurcation of the reputed erstwhile DCM Group.

- The company’s business portfolio consists of Chloro-Vinyl Business, Agri-Rural Business and other Value-Added Businesses.

- It is amongst one of the most cost efficient producers of products and services in all its businesses and has been continuously striving for operational efficiency.

- DCM Shriram, across its various businesses is strategically diversified yet operationally integrated company.

- Some of the businesses feed others, thereby lowering operation costs and making DCM Shriram a highly competitive player.

- The continued focus of the Govt. on agriculture & infrastructure is expected to fuel growth of the agricultural & PVC industry in India.

Businesses:

Chloro-Vinyl Businesses:

- Chlor- Alkali – DCM Shriram’s Chlor-Alkali (Chemicals) buusiness comprises Caustic Soda (Lye and flakes), Chlorine and associated chemicals including Hydrochloric acid, Stable Bleaching powder, Aluminium Chloride, Compressed Hydrogen and Sodium Hypochlorite. The Company has two manufacturing facilities located at Kota (Rajasthan) and Bharuch (Gujarat) with full coal based captive power. The company’s caustic soda capacity at Bharuch is 1345 TPD and at Kota is 498 TPD.

- Plastics Business: A highly integrated business, located at the Kota plant, it involves manufacturing of PVC resins and Calcium Carbide with captive production of Acetylene, Chlorine and Coal based power. Company’s raw carbide capacity stands at 340 TPD and PVC capacity stands at 220 TPD.

Sugar:

capacity of 38,000 TCD. These units have a total power cogeneration capacity of 141 MW and are also supported by 350 KLD of Distillery capacity and a 700 TPD refinery.

Agri-Input Businesses:

Shriram Farm Solutions

Bioseed

Fertiliser

Other Businesses:

Fenesta Building Systems.

Cement

PVC Compounding

Hariyali Kissan Bazaar

| Segment Revenue | |||

| Particulars | FY20 (%) | FY19 (%) | % growth |

| Chlor – Vinyl | 29 | 32 | -9 |

| Sugar | 32 | 30 | 7 |

| Shriam Farm Solution | 10 | 9 | 11 |

| Bioseed | 5 | 6 | -17 |

| Fertiliser | 13 | 13 | 0 |

| Others | 11 | 10 | 10 |

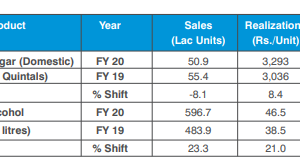

Revenue of Sugar business was up by 7% with higher ethanol volumes as well as better realization of Sugar.

Management:

- Ajay S. Shriram – Chairman & MD

- Vikram S. Shriram – Vice Chairman & MD

- Amit Agarwal – CFO

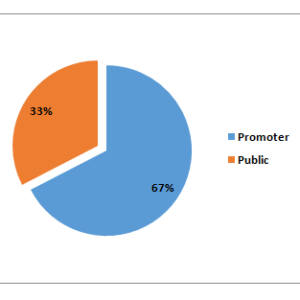

Share Holding Pattern:

Major Holdings:

| Non – Promoters | No. of shares held | % shares held |

| LIC | 10514136 | 6.74 |

| The New India Assurance Company | 1706404 | 1.09 |

| Stepan Holdings Ltd | 7085000 | 4.54 |

| Ristana Services Ltd | 4804550 | 3.08 |

| Salperton Ltd | 1650000 | 1.06 |

| Turnstone Investments Ltd | 1566000 | 1 |

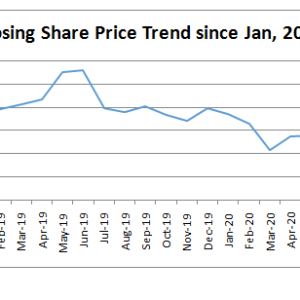

Share Price Trend:

Share Price Snapshot:

| Year | Open (Rs.) | High (Rs.) | Low (Rs.) | Close (Rs.) |

| 2010 | 62.4 | 69.95 | 43.35 | 51.15 |

| 2011 | 52.2 | 59 | 37.5 | 39.75 |

| 2012 | 41 | 86.4 | 39.4 | 68.45 |

| 2013 | 69 | 73.4 | 49.1 | 55.75 |

| 2014 | 57 | 251.45 | 51.1 | 158.55 |

| 2015 | 160.7 | 161.3 | 100 | 133.1 |

| 2016 | 139.2 | 286.45 | 107 | 213.05 |

| 2017 | 214 | 626.9 | 211.7 | 557.9 |

| 2018 | 562.9 | 628.05 | 222.55 | 337.8 |

| 2019 | 338 | 637 | 285.05 | 396.05 |

| 2020 | 400 | 431.1 | 175.8 | 324.15 |

Financials:

Source – Annual Report

The overall operating performance of the Company was stable during the year, with businesses like Sugar, Shriram Farm Solutions, Fenesta and Cement registering growth led by better product prices and volumes. Chlor-Alkali business witnessed a sharp decline in product prices as domestic caustic prices aligned with the international prices.