Reserve Bank of India drops Repo Rate & GDP Growth Forecast

The Monetary Policy Committee (MPC) of the Reserve Bank of India (RBI) met this morning to release the Monetary Policy Report October 2019 which is also attached along with their published Fourth Bi-monthly Monetary Policy Statement, 2019-20

As expected the MPC continues their accommodative stance in light of declining economic growth

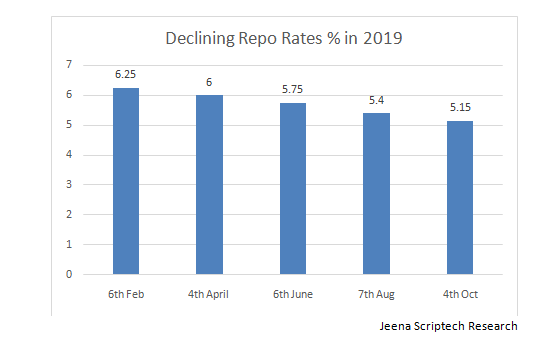

- Repo Rate has been cut by 25 basis points (bps) to 5.15%.It was a unanimous decision by all six members to reduce the rate, with five proposing a 25 bps cut and one a deeper 40 bps cut

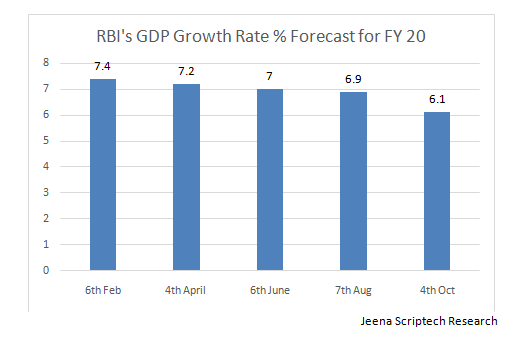

- Gross Domestic Product (GDP) Real Growth Rate Forecast for Financial Year 2019-20 has been reduced for the fifth time this year to 6.1%

Stock Markets React Today

Sensex had actually opened higher by 294 points today over yesterday’s close of 38107 but swung down 728 points to close at 37673.The morning buoyancy is typical of a pre RBI Rate Cut announcement morning & the huge drop that followed is more in following sombre global cues & the confirmation that GDP Growth Rate Forecast is now even lower at 6.1% for FY 20

In this context it’s retracted nearly half the 3000 points euphoric bounce back buoyancy from 36000 to 39000 inside days by the historic Corporate Tax Rate Cut announced by the Government on Friday , September 20,2019 .Nifty closed at 11175 today, down 139 points from yesterday. It had rebounded brilliantly from 10700 to 11600 when the tax rates were cut

A Fifth Repo Rate Cut in 2019

The Reduction is now a full 135 bps from last year, with 110 bps through Five Cuts in this year 2019 alone as below from 6.25% to 5.15%. All cuts have been 25 bps ,except for the higher 35 bps last time around on August 7,2019

RBI complains that the Monetary Transmission of such Repo Cuts has been staggered and incomplete in that despite the past 110 basis points cut earlier this year in the period Feb-Aug 2019 the weighted average lending rate on fresh loans by commercial banks has declined only 29 basis points while the rate has actually gone up 7 basis points on outstanding loans in the same period

Now with Transmission expected to improve with the linking of lending rates to the repo rates, it is expected that Credit Offtake will pick up , liquidity will improve ,boosting the Investment cycle & stimulating growth

Expect a sixth Repo Cut later in the year for the Rate to go sub 5%

GDP Growth Rate Forecast drops to 6.1% for FY 20

GDP Growth Rate has been declining rapidly with Q 4 FY 20 recording 5.8 % followed by an even more worrying 5 % in Q 1 FY 20

It has forced five Repo Cuts already this year in 2019 thus far .

RBI has for the fifth time this year reduced it’s GDP Real Growth Rate Forecast for FY 20. It’s now 6.1%

GDP Growth Rate % forecast for next Financial Year FY 21 too has been reduced from 7.4% to 7.2%

Inflation remains benign and the MPC projects a slightly higher 3.4% for Q 2 FY 20 & a range of 3.5 to 3.7% in the second half of FY 20 that has just commenced and 3.6% for FY 21

This would indicate a much lower Nominal GDP Growth Rate of 9.5 to 9.6 % from the 12 % assumed in the first week of July 2019 Union Budget Presentation by our Finance Minister, Mrs Nirmala Sitharaman

In an earlier Scrip Standpoint of September 24,2019 , on the basis of the Rs 1,45,000 crs Corporate Tax Loss Sacrifice by the Government that the FM declared when she announced on September 20,2019 a one shot effective Tax Rate Cut from @ 35% to @25% from FY 20 itself , we had assumed a lower GDP Growth of 9.5% & a higher Fiscal Deficit that would challenge us to keep the Deficit at 3.3% of GDP.It would rise to 4.1% unless , of course, the Government compensates this Tax sacrifice through higher Non Tax Revenues as it intends.We had examined in detail the components of this Non Tax Revenue Stream too

We reproduce the Adjsuted Fiscal Deficit Table from the above earlier Note in our Scrip Standpoint Module

| Head | FY 20 Budget Estimates in Rs Crs/US $ B |

| Nominal GDP | 2,11,00,607 / 2951 ( US $ 3 Trillion) |

| Fiscal Deficit | 7,03,760 / 98 => 3.3 % of GDP |

| Sacrifice of Corporate Tax Revenue | 1,45,000 / 20 |

| Adjusted Fiscal Deficit | 8,48,760 / 119 => 4 % of GDP |

| Adjusted FY 20 GDP at lower assumed 9.5% nominal growth | 2,06,30,600/2885(US$ 2.9 Trillion) |

| Adjusted Fiscal Deficit as a % of Adjusted GDP | 8,48,760 / 2,06,30,600 => 4.1 % |

Jeena Scriptech Research

To conclude ,RBI clearly has it’s hands full :

- Toxicity of Non Performing Assets of Banks continuing to affect the Banking Sector

- Government drawing & depleting RBI Reserves in an unprecedented manner thus impinging on the latter’s autonomy

- Declining Economic Growth

- Managing the Rupee to be in stable range though a school of thought wants yet again a one time significant devaluation that had heralded the modern reforms in 1991 when Dr Manmohan Singh was the FM

RBI thus is doing what it can only do in such a backdrop as it states in the MPC Statement issued today

“continue with an accommodative stance as long as it is necessary to revive growth, while ensuring that inflation remains within the target”

Disclosure & Disclaimer

Jeena Scriptech Alpha Advisors Pvt Ltd (JSAAPL )is a SEBI Registered Entity offering Fundamental Direct Equity Research Analysis, Equity Portfolio Advisory, Training & Mentoring Services in Capital Markets

This Report is under our free access SCRIP STANDPOINT Module.It is for the personal information of the recipient/reader.We we are not soliciting any action based upon it. This report is not to be construed as an offer to sell or the solicitation of an offer to buy any security in any jurisdiction. It is our Viewpoint for general information purposes only.It does not take into account the particular investment objectives, financial situations, or needs of individuals & other entities .We have reviewed the report, and in so far as it includes current or historical information, it is believed to be reliable though its accuracy or completeness cannot be guaranteed. Neither JSAAPL, nor any person connected with it, accepts any liability arising from the use of this document. The recipients of this material should rely on their own investigations and take their own professional advice. Opinions expressed are our current opinions as of the date appearing on this material only.No part of this material may be duplicated in any form and/or redistributed without JSAAPL’s prior written consent.

In case you require any clarification or have any concern, kindly write to us at : [email protected]