BONDING WITH GOLD

Gold has always been the ‘go to’ asset for most Indians , more for security than for returns

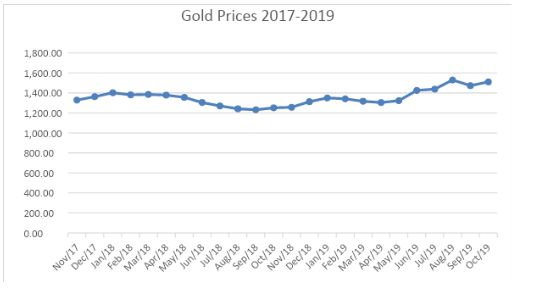

Yet the returns from Gold have been sparkling in just a year from 2018 Dhanteras,the auspicious day to buy Gold, to date in October 2019

In fact it’s CAGR too has been more or less matched Equities over a 10 year & 20 Year period this millineum .

Gold is one of the largest imports of India and is subjected to a duty of 12.5% in the 2019 budget as opposed to the previous 10%, plus 3% GST.

Globally, gold is quoted in dollars per troy ounce. In order to understand the Rupee per gram price, dollars need to be converted to rupees and ounces to grams.

Current Gold Price: $1506/ounce

1 troy ounce=31.10 grams

1 dollar= Rs. 71.05

Gold price in India: Rs. 3948/g

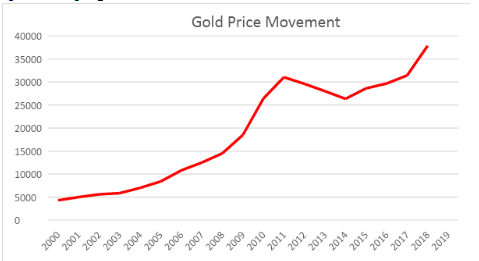

Gold has given consistent returns in the past 2 decades. Despite the fact that it has almost never outperformed equity, it has been a way to hedge against economic crises.Below is the approximate return gold has generated in the past 10 and 20 years.

| 10 Years | 20 Years | |

| CAGR | 10.08% | 12% |

| Absolute | 161% | 761% |

Another important thing to note is that the returns on gold have almost always been upward sloping and consistent.

Given that gold is consistent and safe, how do investors gain exposure to this asset class in their portfolio?

The obvious choice is buying physical gold but the carrying costs and safety risks associated to that outweigh the benefits of holding physical gold being increased liquidity.

Another way is gold Exchange Traded funds:

Gold ETFs are comparatively safer but generate lower returns than actual gold due to the management fees and attract long term capital gains tax after 3 years. Gold ETFs cannot be used as collaterals for loans either.

| Physical Gold | Gold ETF | |

| Returns | Making Charges may reduce returns | Less than actual return on gold |

| Risks | Prone to wear and tear/ theft | Comparatively safer an in e-form |

| Purity | Needs to be checked | High as it is in electronic form |

| Taxability | LTCG after three years | LLTCG after three years |

| Collateral for loan | Can be used as collateral | Cannot be used as collateral |

| Liquidity | Need to find buyers in person | Tradable on Stock Exchange |

| Carrying Costs | High | Lower as held in e-form. |

So how does one then gain exposure to gold without the risks associated to holding it physically and with the ability to use it as a collateral for a loan.

This is where the benefits of Sovereign Gold Bonds come into play.

Sovereign Gold Bonds are government securities issued by Reserve Bank on behalf of Government of India denominated in grams of gold. They are substitutes for holding physical gold. Investors have to pay the issue price in cash and the bonds will be redeemed in cash on maturity (8 years) the bonds can be redeemed prematurely after the 5th year on coupon payment dates.In addition to any capital gains,investors are paid 2.5% interest p.a on a semi annual basis where the amount is directly credited to their bank account.

Any investor (Individuals, HUFs, Trusts, Universities and Charitable Institutions) can buy a minimum of 1g to a maximum of 4kg-Individuals and HUF and 20kg -Trusts and similar institutions.

SGBs provide tax benefits, can be used as collateral for loans with the same loan to value ratio as physical gold and investors get paid a small rate of interest from the GoI.

The returns of SGB are similar to the returns of actual gold but due to the fact that SGB are illiquid in nature, selling the bonds in the secondary market may provide lower returns and holding the bond to maturity maybe more beneficial from the return and tax perspective.

Taxability:

Interest on the Bonds will be taxable as per the provisions of the Income-tax Act. The capital gains tax arising on redemption of SGB to an individual has been exempted. The indexation benefits will be provided to long terms capital gains arising to any person on transfer of bond before maturity.

Loan Against the Bond:

these securities are eligible to be used as collateral for loans from banks, financial Institutions and Non-Banking Financial Companies (NBFC). The Loan to Value ratio will be the same as applicable to ordinary gold loan prescribed by RBI from time to time. Granting loan against SGBs would be subject to decision of the bank/financing agency.

Primary v/s Secondary:

The liquidity risks associated with SGBs mean that they will always be available in the secondary market at a discount of 5-6% to the market vale of gold.The price of Sovereign Gold Bonds 2.75% NOV 2023 Tr-I Ltd. Is currently Rs. 3680.(10/10/19) This Bond will be redeemable on coupon dates from 2020.

The RBI is currently issuing Tr-5 bonds at Rs.3738 at 2.5% The tenor of the Bond will be for a period of 8 years with exit option after 5th year to be exercised on the interest payment dates. This means that today, a sovereign gold bond which can be redeemed with the RBI next year onwards is available at a cheaper price.

Despite the fact that the coupon payments will be around Rs 20 p.a. lower on the Nov 2023 bond (2.75% on issue price Rs.2684 approximately), we cannot ignore the capital appreciation potential and the increased liquidity of it. If one anticipates the global gold prices to increase at a rate that outweighs the difference in coupon payments Rs. 20, then perhaps buying the bond from the secondary market will provide superior returns in the short term and if one holds the bond to maturity in 2023 then they will receive the tax advantage as LTCG on redemption on SGBs is exempted.

Given the price history of gold in the past 2 years the capital gain outweighs the interest payments to investors

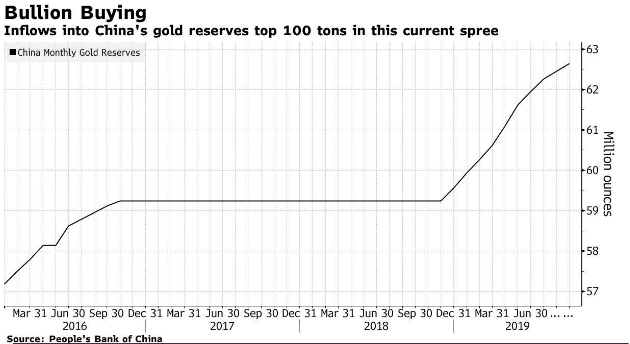

Ultimately the reason for investing in SGBs is to protect your capital and take advantage of the appreciation in gold prices without going through the trouble of storing it physically and taking he risks associated with holding gold. The proceeds from SGBs also help the Government and the government can keep better track of the amount of gold held by the citizens of India. In previous years the Government came up with the gold monetisation scheme in order to bring the black market gold into the economy as Indians hold more gold than official numbers state. The SGBs help with this cause as well encouraging the switch from physical to electronic form gold.

Disclosure & Disclaimer

Jeena Scriptech Alpha Advisors Pvt Ltd (JSAAPL )is a SEBI Registered Entity offering Fundamental Direct Equity Research Analysis, Equity Portfolio Advisory, Training & Mentoring Services in Capital Markets

This Report is under our free access SCRIP STANDPOINT Module.It is for the personal information of the recipient/reader.We we are not soliciting any action based upon it. This report is not to be construed as an offer to sell or the solicitation of an offer to buy any security in any jurisdiction. It is our Viewpoint for general information purposes only.It does not take into account the particular investment objectives, financial situations, or needs of individuals & other entities .We have reviewed the report, and in so far as it includes current or historical information, it is believed to be reliable though its accuracy or completeness cannot be guaranteed. Neither JSAAPL, nor any person connected with it, accepts any liability arising from the use of this document. The recipients of this material should rely on their own investigations and take their own professional advice. Opinions expressed are our current opinions as of the date appearing on this material only.No part of this material may be duplicated in any form and/or redistributed without JSAAPL’s prior written consent.

In case you require any clarification or have any concern, kindly write to us at : [email protected]