Iol Chemicals and Pharmaceuticals Ltd.

Pharmaceuticals

FV – Rs 10; 52wks H/L – 833.40/147.35; TTQ – 2.5 Lacs; CMP – Rs 737.65 (As On July 24, 2020);

Market Cap – Rs 4300.91 Crs

Consolidated Financials and Valuations (Amt in Rs Crs unless specified)

| Year | Equity Capital | Net Worth | Long Term Debt | Total Sales | PAT | BV | EPS | P/E | P/BV | Promoter’s Holdings |

| Rs Cr. | Rs Cr. | Rs Cr. | Rs Cr. | Rs Cr. | Rs | Rs | % | |||

| 2020 | 57 | 814 | 56 | 1894 | 361 | 143.00 | 63.51 | 11.62 | 5.16 | 43.69 |

| 2019 | 57 | 474 | 258 | 1685 | 237 | 83.38 | 41.61 | 17.73 | 8.85 | 41.89 |

About the Company:

IOLCP is India’s one of the leading generic pharmaceutical company, and is a significant player in the Organic chemicals space. IOLCP has a wide presence across various therapeutic categories like, Pain Management, Anti-diabetic, Anti hypertensive, AntiConvulsants, etc.

The company deals in APIs(Active Pharmaceutical Ingredients) and Speciality Chemicals

It has an API capacity of 12000 TPA which is roughly 34.2% of India’s total API capacity.

API:

In the API division the company presently has a commercial distribution in 6 products:

- Ibuprofen (nonsteroidal anti-inflammatory drug -NSAID)

- Metformin Hydrochloride (mainly used to control high blood sugar)

- Lamotrigine ( used to treat epilepsy and bipolar disorder)

- Fenofibrate ( used to reduce the amounts of cholesterol and triglycerides in the blood)

- Clopidogrel Bi sulphate ( Stimulates platelets aggression)

- Ursodeoxycholic acid ( used to reduce the amounts of cholesterol)

They have 10 more products in the advance stage of development

Speciality Chemicals:

- Ethyl Acetate (Paints, Varnishes, Cleaning Mixtures)

- Iso Butyl Benzene ( manufacture of Ibuprofen)

- Acetyl Chloride ( used in organic synthesis and dyes)

- Mono Chloro Acetic Acid ( used to make plastics, pharmaceuticals, flavors, cosmetics)

Board of Directors:

- Rajender Mohan Malla (Chairman and Independent Director)

- Varinder Gupta (Managing Director)

- Vijay Garg (Joint Managing Director)

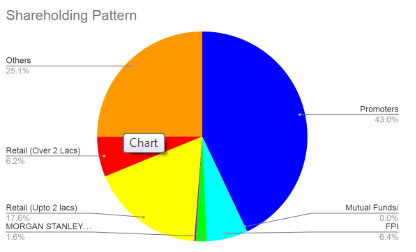

Shareholding Pattern:

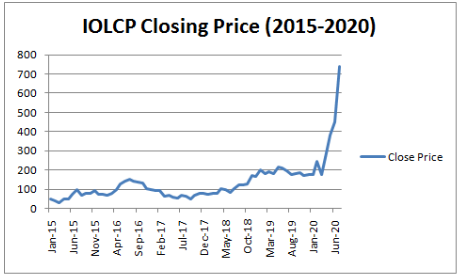

Price History:

Peer Comparison:

(All Figures in Rs Cr. unless specified)

| IOLCP | Granules | Divis | Solara | |

| Price (Rs) | 737.65 | 280.3 | 2397.25 | 650.5 |

| FV (Rs) | 10 | 1 | 2 | 10 |

| Market Cap | 4300.91 | 7127 | 63639 | 1747 |

| Equity | 57 | 25 | 53 | 27 |

| Net Worth | 814 | 1844 | 7310 | 1086 |

| Total Debt | 56 | 793 | 34 | 587 |

| Sales | 1894 | 2599 | 5394 | 1322 |

| Net Profit | 361 | 335 | 388 | 115 |

| EPS (Rs) | 63.5 | 13.2 | 14.6 | 42.6 |

| BV (Rs) | 143.0 | 72.5 | 275.4 | 404.3 |

| PE | 11.6 | 21.2 | 163.9 | 15.3 |

| PB | 5.2 | 3.9 | 8.7 | 1.6 |

| API Capacity (TPA) | 12000 | 4800 | 5000 |