Shivam Autotech Ltd

Auto Parts & Equipments

FV – Rs 2; 52wks H/L – 36.9/15; TTQ – 16 K; CMP – Rs 27 (As On December 7, 2021);

Market Cap – Rs 272 Crs

Consolidated Financials and Valuations for FY21 (Amt in Rs Crs unless specified)

Equity Capital |

Net worth |

Debt | Total Sales |

PAT | BV (Rs) |

EPS (Rs) |

P/E |

P/BV |

Promoter’s Stake |

| 20 | 113 | 382 | 487 | -23 | 11 | -2.3 | – | 2.5 | 74.8 |

Consolidated Financials and Valuations for H1 FY22 (Amt in Rs Crs unless specified)

Equity Capital |

Net worth |

Debt | Total Sales |

PAT | BV (Rs) |

EPS (Rs) |

P/E |

P/BV |

Promoter’s Stake |

| 20 | 91 | 405 | 243 | -22 | 9 | -2.2 | – | 3 | 74.8 |

Key Updates:

- The Company has made a Rights issue of equity shares of Rs. 2 each in the ratio of 2:9 (2 shares for every 9 shares held) at a premium of Rs. 16 each.

- 18 per Rights Equity Share (including a premium of Rs. 16 per Equity Share over face value of Rs.2 per Equity Share); total amount aggregating not exceeding Rs.40 crores as approved by Stock Exchange.

- {https://www.bseindia.com/xml-data/corpfiling/AttachHis/5FE76FB3-805E-455F-B9EE-6198053D4F7F-083115.pdf}

- Despite the pandemic, export sales for the FY 2020-21 was Rs. 17.7 Crs as compared to Rs. 8.9 Crs, registering an increase of 99%.

- The Company remains cautiously optimistic about growth in the next financial year, as a credible recovery in the Indian economy and a positive momentum towards personal mobility.

Overview:

- Shivam Autotech Ltd is one of the largest and most renowned manufacturers of transmission gears and shafts in India.

- The company has been serving a large number of automobile manufacturers as their strategic and supply chain partners for the past 20 years. Since inception, the Company has undergone a multi-phased development and evolution journey.

- The company manufactures a comprehensive range of auto components and accessories that primarily include transmission gears, transmission shafts, alternator components, starter motor components, magneto components, steering components and various precision engineering components and is the leader within the industry.

- The company has plants at 4 strategic locations including Gurgaon, Haridwar, Bengaluru and Rohtak.

The company’s clientele includes:

Management:

Mr. Bhagwan Dass Narang – Chairman

Mr. Neeraj Munjal – MD

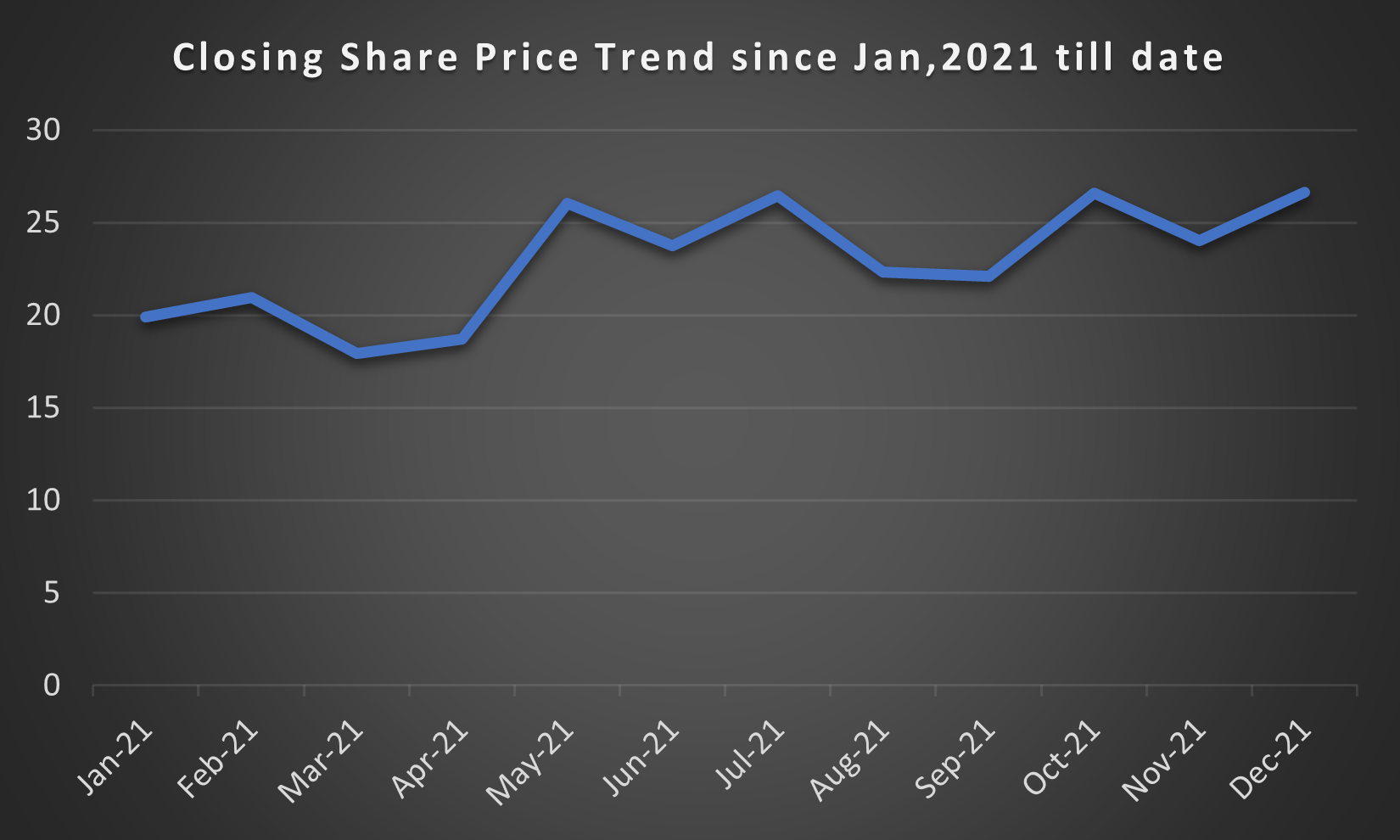

Share Price Trend:

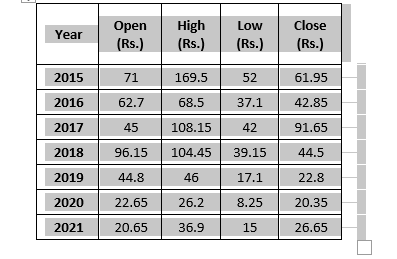

Share Price Snapshot:

On 8th October 2015 the company made a bonus issue in the ratio of 1:1.

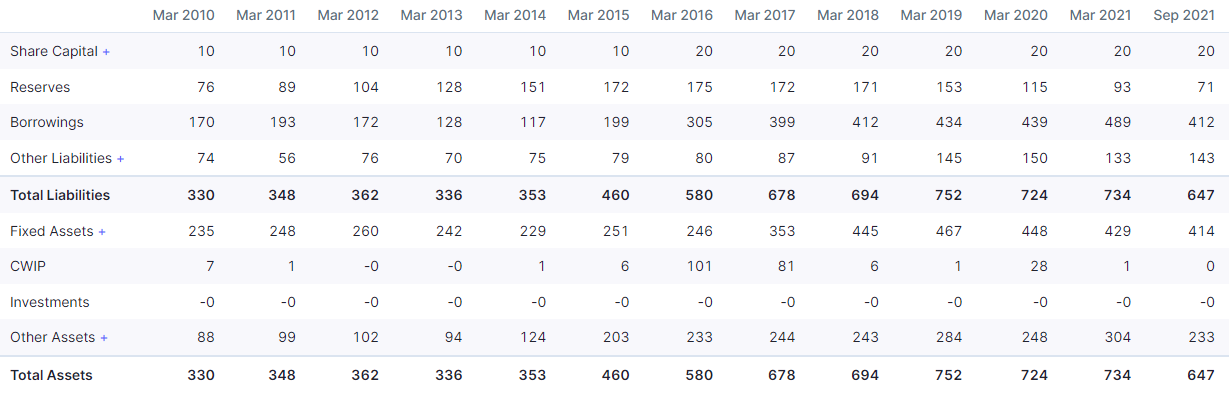

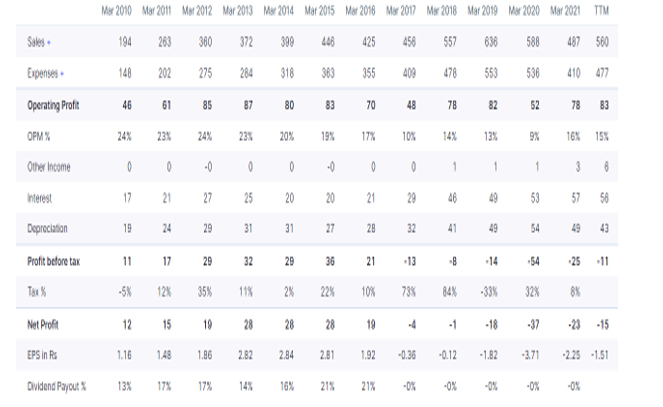

Financials: (Rs. Crs)