Advanced Enzyme Technologies Ltd

Textiles

FV – Rs 2; 52wks H/L – 225/91.05; TTQ – 5528; CMP – Rs 153 (As On June 2, 2020);

Market Cap – Rs 1712 Crs

Consolidated Financials and Valuations (Amt in Rs Crs unless specified)

Equity Capital |

Net worth |

Long Term Debt | Total Sales |

PAT | BV (Rs) |

EPS (Rs) |

P/E |

Industry P/E |

P/BV |

Promoter’s Stake |

|

| FY20 | 22.34 | 839 | 16 | 450 | 133 | 75 | 11.9 | 12.9 | 16.18 | 2.04 | 57.88 |

| FY19 | 22.33 | 679 | 28 | 425 | 111 | 61 | 9.95 | 15.4 | 16.18 | 2.5 | 57.86 |

| Q3 FY20 | 22.34 | 777 | 19 | 338 | 100 | 70 | 8.9 | 17.2 | 16.18 | 2.2 | 57.88 |

Debt to Equity – 0.02

ROE – 16%

Market Cap/Sales – 3.8

Overview:

- Advanced Enzyme Technologies Limited (AETL) is a research driven company with global leadership in the manufacturing of enzymes and probiotics.

- They are the largest Indian enzyme company, engaged in the research and development, manufacturing and marketing of 400+ proprietary products developed from over 68+ indigenous enzymes and probiotics.

- The company is committed to providing eco-safe solutions to a wide variety of industries like human health care and nutrition, animal nutrition, baking, fruit & vegetable processing, brewing & malting, grain processing, protein modification, dairy processing, speciality applications, textile processing, leather processing, paper & pulp processing, bio-fuels, bio-mass processing, bio-catalysis, etc.

- AETL comprises of four wholly owned direct subsidiaries, two subsidiaries (60% & 70%) and five step-down wholly owned subsidiaries

- The company has 7 plants on operational basis in India and overseas.

Key Updates:

- The company acquired in this quarter a land of 15 acre in Nasik and that they are building a modern R&D center and we are thinking about Rs.100 Crores in the next 3 years as a capital investment for the R&D center.

- The company mentioned in the earning call of Q3 that they plan to grow at 15 – 20% on yoy basis.

Contribution to Revenue:

| Segments | 2020 % | 2019 % |

| Human Nutrition | 75 | 76 |

| Animal Nutrition | 12 | 12 |

| Bio- Processing Segment | 13 | 12 |

| Total | 100 | 100 |

43% revenue is from India and 57% from Overseas.

On the Operations front, capacity utilization is in the range of 52%-55%.

Geographical Revenue Split:

| Revenue | 2020 (%) | 2019 (%) |

| Asia (ex- India) | 6 | 4 |

| Others | 2 | 2 |

| India | 43 | 40 |

| Europe | 7 | 5 |

| USA | 42 | 49 |

| Total | 100 | 100 |

Management:

- V. L. Rathi – Chairman

- Beni Prasad Rauks – CFO

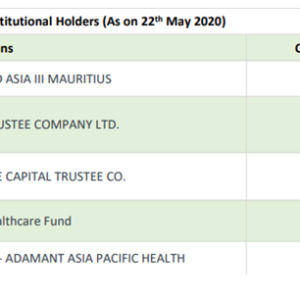

Major Holdings:

Subsidiaries Performance:

| Subsidiaries | Revenue | PAT |

| (Rs. Crs) | ||

| Advanced Bio-Agro Tech Ltd | 40 | 5.5 |

| Advanced EnzyTech Solutions | 9 | 0.5 |

| JC Biotech Private Ltd | 49 | 9.8 |

| Advanced Supplementary Technologies Corporation | 213 | 82 |

| *Advanced Enzymes (Malaysia) Sdn. Bhd | Trial basis | -0.5 |

| Advanced Enzymes Europe B.V. | 17 | -12 |

| evoxx technologies GmbH | 17 | -6 |

* The said subsidiary was acquired in 2017 (incorporated in 2016) will be engaged in supplying and providing enzyme based solutions for extraction of palm oil from palm fruits.

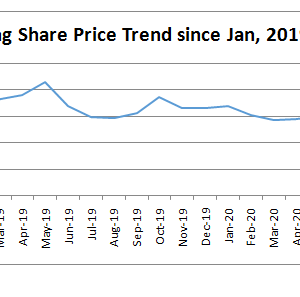

Share Price Trend:

Price Snapshot:

| Year | Open (Rs.) | High (Rs.) | Low (Rs.) | Close (Rs.) |

| 2016 | 1210 | 2377 | 1161 | 1984 |

| 2017 | 2000 | 2225 | 244 | 276 |

| 2018 | 278 | 323 | 165 | 178 |

| 2019 | 180 | 225 | 142 | 165 |

| 2020 | 167 | 187 | 91 | 150 |

On 25th May 2017 there was a stock split of Rs 10/-to Rs 2/-

Risks:

- Competiton Risk

- Forex Risk

- Customer Satisfaction

- Duplicacy