Paras Defence & Space technologies Ltd

- Pricing Of the Issue :

| IPO Opening Date | Sep 21, 2021 |

| IPO Closing Date | Sep 23, 2021 |

| Issue Type | Book Built Issue IPO |

| Face Value | Rs.10 per equity share |

| IPO Price | Rs.165 to Rs.175 per equity share |

| Market Lot | 85 Shares |

| Listing At | BSE, NSE |

| Issue Size | Rs. 170.78 Crs |

| Fresh Issue | Rs. 140.6 Crs (8034286 Eq. Shares of Rs.10 each) |

| Offer for Sale | 1724490 Eq Shares of Rs. 10 |

| (aggregating up to ₹30.18 Cr) | |

| BRLM | Anand Rathi Advisors |

The company has undertaken a Pre-IPO Placement of 2,552,598 Equity Shares at average price of Rs. 134.76/ – per share, aggregating to ₹ 34.40 Crore.

2.Planned Usage of Funds:

- Fund capital expenditure requirements.

- Funding incremental working capital requirements.

- Repayment or prepayment of all or a portion of certain borrowings/outstanding loan facilities availed by the company.

- General Corporate purposes.

3.Promoters:

- Sharad Virji Shah is the Chairman of the company.

- Munjal Sharad Shah is the Managing Director of the company.

- Harsh Dhirendra Bhansali is the Chief Financial Officer of the company.

4.Products& Services, Places & Plants:

Paras Defence and Space Technologies Limited (“Paras Defence”) was incorporated on June 16, 2009. Paras Defence is one of the leading ‘Indigenously Designed Developed and Manufactured’ (“IDDM”) category Indian private sector company engaged in designing, developing, manufacturing and testing of a wide range of defence and space engineering products and solutions.

Paras Defence caters to 5 major segments of Indian defence sector:

- Defence and Space Optics: High precision optics for defence and space applications such as thermal imaging and space imaging systems;

- Defence Electronics: Providing a wide array of high performance computing and electronic systems for defence applications, including sub systems for border defence, missiles, tanks and naval applications;

- Electro-Magnetic pulse (“EMP”) protection solution: EMP Racks, EMP filters used for protection of data and power lines within a rack/shelter/room against electro-magnetic pulse or interference.

- Heavy Engineering: components for rockets and missiles along with mechanical manufacturing support to other verticals.

- Niche Technologies: identified and partnered with some of the leading technology companies around the world in order to indigenise advanced technologies in the defence and space sectors for catering to the Indian market.

Order Book as on June 30,2021:

| Particulars | No. of orders | Value (Rs.Crs) |

| Defence and Space Optics | 37 | 202.64 |

| Defence Electronics | 49 | 70.56 |

| Heavy Engineering | 34 | 31.79 |

| Total | 304.99 |

- Participation in Equity:

| Pre – Offer | Post – Offer | ||||

| Shareholders | No. of Shares | % of Capital | Shares Offered | No. of Shares | % of Capital |

| Promoter & Promoter Group | 24587250 | 79.40% | 1300000 | 23287250 | 59.71% |

| Public – Individual | 2837498 | 9.16% | 424490 | 2413008 | 6.19% |

| Public – Others | 3541027 | 11.44% | 13299803 | 34.10% | |

| Total | 30965775 | 100.00% | 1724490 | 39000061 | 100.00% |

Post Issue Market Cap = Rs. 683 Crs. (At Upper Price Band, 39000061* Rs.175)

6.Performance, Prospects & Pains:

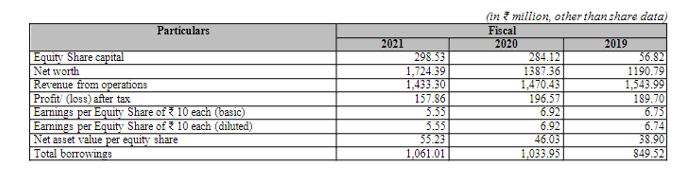

Financial Info:

7.Peers:

The Company does not have any listed peers in India.

8.Policy:

Any Change in the New Industrial Policy and from Department of Military Affairs will ffcet the Company.