Sugar

FV – Rs 1; 52wks H/L – 10.91/3.2; TTQ (Lac) – 3.47; CMP – Rs 7.69 (As On June 19, 2020); Market Cap – Rs 1474.03 Crs

Consolidated Financials and Valuations (Amt in Rs Crs unless specified)

| Shri Renuka Sugars Ltd | ||||||||||

| Year | Equity Capital | Net Worth | Long Term Debt | Total Sales | PAT | BV | EPS | P/E | P/BV | Promoter’s Holdings |

| Rs Cr. | Rs Cr. | Rs Cr. | Rs Cr. | Rs Cr. | Rs | Rs | % | |||

| 2019/20 (9M) | 192 | 1744 | 2228 | 3504 | 2095 | 9.10 | 10.93 | 0.53 | 0.85 | 50.03 |

| 2018/19 | 192 | -3008 | 2524 | 4718 | -2037 | -15.69 | -10.63 | – | – | 50.05 |

One off profit from discontinued operations was Rs 2516 Cr for 9m FY20

Peer Comparison:

| Shri Renuka Sugar (9m) | Triveni Engg | Balrampur (9m) | Dhampur | |

| Price (Rs) | 7.69 | 53.9 | 128.9 | 129.7 |

| FV (Rs) | 1 | 1 | 1 | 10 |

| Market Cap | 1474 | 1336 | 2836 | 861 |

| Equity | 192 | 25 | 22 | 66 |

| Net Worth | 1744 | 1339 | 2173 | 1362 |

| Total Debt | 2228 | 1387 | 1526 | 1617 |

| Sales | 3504 | 4473 | 3019 | 3556 |

| Net Profit | 2095 | 335 | 278 | 216 |

| EPS (Rs) | 10.9 | 13.5 | 12.6 | 32.4 |

| BV (Rs) | 9.1 | 54.0 | 98.8 | 204.9 |

| PE | 0.5 | 4.0 | 7.7 | 4.0 |

| PB | 0.8 | 1.0 | 1.3 | 0.6 |

| Crushing Capacity(TCD) | 37500 | 76500 | 45500 | |

| Tonnage (MT) | 1.01 | 0.483 | 0.766 |

Triveni Engg Crushing Capacity : 8.5 MT for fy 2020

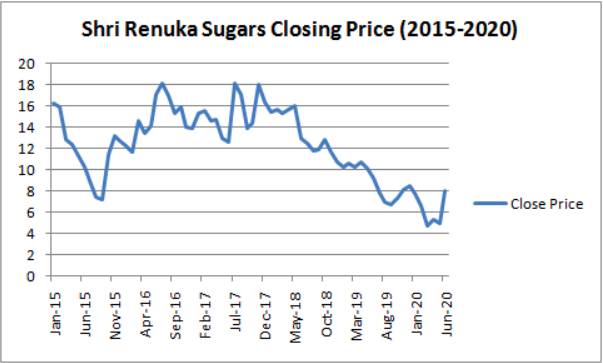

Price Chart:

About the Company :

Since 2019, Wilmar Sugar Holding Pte.Ltd has become the holding Company by acquiring 58.34% of stake

Shree Renuka Sugars is a global agribusiness and bio-energy corporation. The Company is one of the largest sugar producers in the world, the leading manufacturer of sugar in India, and one of the largest sugar refiners in the world.

Sugar: The Company operates seven sugar mills in India with a total crushing capacity of 7.1 MTPA or 37,500 TCD and two port based sugar refineries with capacity of 1.7 MTPA.

Ethanol: The Company manufactures fuel grade ethanol that can be blended with petrol. Distillery capacity is 930 KLPD (630 KLPD from molasses to ethanol and 300 KLPD from rectified spirit to ethanol).KBK Chem-Engineering (100% subsidiary) facilitates turnkey distillery, ethanol and bio-fuel plant solutions

Power:The Company produces power from bagasse (a sugar cane by product) for captive consumption and sale to the state grid in India. Total Cogeneration capacity is 242 MW with exportable surplus of 135 MW.

| Segment

FY 19 |

Contribution % | Amount (Rs. Crs) |

| Sugar | 77.16 | 3689.37 |

| Ethanol | 11.06 | 528.63 |

| Co Generation | 8.46 | 404.49 |

Recent News:

In a regulatory filing on June 3, the company said its board approved the proposal for raising funds from its holding company Wilmar Sugar Holdings through external commercial borrowings (ECB) to refinance existing debts.

“The board also passed resolutions for increasing the borrowing limits under Section 180(1)(c) of the Companies Act, 2013 (the Act) from the existing Rs 6,000 crore to Rs 10,000 crore, and the corresponding limits for creating a charge on the assets of the company to secure such borrowings under Section 180(1)(a) of the Act,” the company said.