Steel Exchange India Ltd

Iron & Steel/ Interm.Products

FV – Rs 10; 52wks H/L –263.5/45.1 ; TTQ – 3500 ; CMP – Rs 220 (As On February 15th, 2022) ;

Market Cap – Rs 1973 Crs

Consolidated Financials and Valuations for FY21 (Amt in Rs Crs unless specified)

Equity Capital |

Net worth |

Debt | Total Sales |

PAT | BV (Rs) |

EPS (Rs) |

P/E |

P/BV |

Promoter’s Stake |

| 80.39 | 302 | 508 | 898 | 140 | 38 | 12.6 | 12 | 5.7 | 49.78 |

Consolidated Financials and Valuations for H1 FY22

Equity Capital |

Net worth |

Debt |

Total Sales |

PAT | BV (Rs) |

EPS (Rs) |

P/E |

P/BV |

Promoter’s Stake |

| 80.08 | 294 | 508 | 470 | -8 | 37 | -1 | – |

5.9 |

49.72 |

The company has successfully paid Rs.510.17 Crores and settled the dues of all the Lenders on 29.01.2021 that was almost 7 Months before the due date 31.08.2021 of OTS (One Time Settlement) by raising listed NCDs under private placement amounting to Rs.382.80 crores which was subscribed to by group of Investors led by M/s Edelweiss and the remaining Rs.17.20 Crores by way of equity share subscription for 44,04,059 equity shares on 01.02.2021 at a price of Rs.39 per share which includes share premium of Rs.29 per share by group of Investors led by M/s Edelweiss.

The Company approved allotment of over Rs. 2.3 crs Compulsory Convertible Debentures and 5822150 Convertible Warrants at Rs.72.5 each.

Overview:

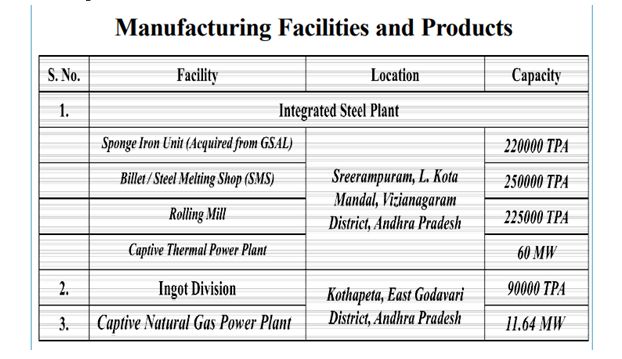

- Steel Exchange India Ltd has been established in the field of iron and steel manufacturing and is the AP’s largest private integrated steel plant. The company aims to grow as a quality steel product hub, increasing the customer base and clientele organizations.

- The Company was incorporated in Februarary 1999 as Pyxis Technology Solutions Ltd.

- The company promoted by team of technocrats, friends and relatives.

- In December 1999 the Steel Exchange India Ltd was incorporated as 100 percent subsidiary of Pyxis Technologies.

Management:

- B. Satish Kumar – CMD

- B. Ramesh Kumar – CFO

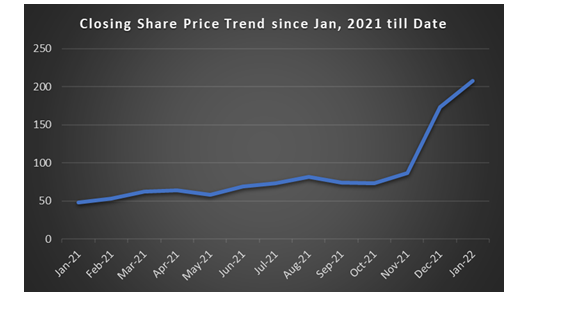

Share Price Trend:

Share Price Snapshot:

| Year | Open (Rs.) | High (Rs.) | Low (Rs.) | Close (Rs.) |

| 2015 | 57 | 65.6 | 28.6 | 44.75 |

| 2016 | 44.9 | 94.95 | 26.2 | 88.9 |

| 2017 | 88 | 133.45 | 32.25 | 42.15 |

| 2018 | 42.1 | 50.65 | 13.6 | 15.4 |

| 2019 | 15 | 25.25 | 9.06 | 25.25 |

| 2020 | 26.5 | 47.05 | 11.61 | 46.3 |

| 2021 | 47.8 | 185 | 45.1 | 173.3 |

| 2022 | 174.45 | 263.5 | 174.45 | 207.9 |

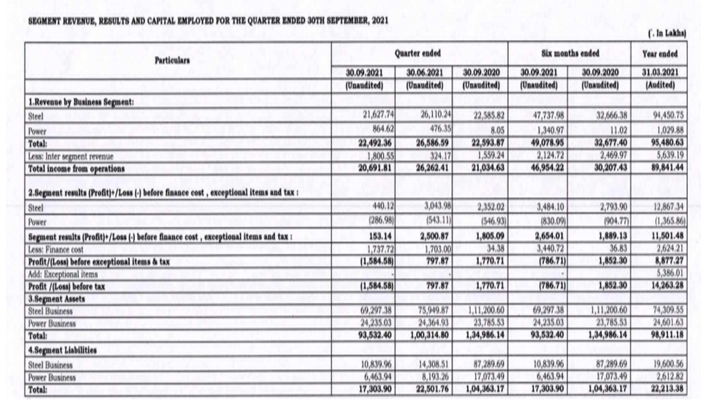

Segment Results: