Vedanta Ltd

Price: Rs 92.95

FV: Rs 1

MCAP: Rs 34514 Crs

52 W High: Rs 179.95

52 W Low: Rs 60.3

Financials:

All figures in Rs Cr. except for BV and EPS

| 15/05/2020 | Vedanta Ltd | |||||||||

| Year | Equity Capital | Net Worth | Long Term Debt | Total Sales | PAT | BV | EPS | P/E | P/BV | Promoter’s Holdings |

| Rs Cr. | Rs Cr. | Rs Cr. | Rs Cr. | Rs Cr. | Rs | Rs | % | |||

| 2019/20 9m | 372 | 73385 | 46561 | 66575 | 7339 | 197.27 | 19.73 | 3.53 | 0.47 | 50.14 |

| 2018/19 | 372 | 62297 | 57703 | 96066 | 9698 | 167.47 | 26.07 | 3.57 | 0.56 | 50.14 |

Vedanta Limited, formerly known as Sesa Sterlite/Sesa Goa Limited, is a mining company based in India, with its main operations in iron ore, gold and Aluminium mines in Goa, Karnataka, Rajasthan and Odisha.

Mr. Anil Agarwal is the Chairman of the company.

Segment Revenue Breakup:

All figures in Rs Cr unless specified

| Head | 9m 2020 | 2019 | |

| India | Zinc and Lead | 12023 | 18088 |

| Silver | 1843 | 2568 | |

| International | Zinc | 2395 | 2738 |

| Oil and Gas | 10257 | 13223 | |

| Aluminium | 20199 | 29229 | |

| Copper | 6797 | 10739 | |

| Iron Ore | 2390 | 2911 | |

| Power | 4656 | 6524 | |

| Others | 3558 | 5023 | |

| Less Inter Segment Transfers | -86 | -142 | |

| Revenue from Operations | 64032 | 90901 |

Equity History:

| Year | No. of shares | |

| 2001 | 100 | |

| 2005 | 200 | Bonus issue of 1:1, 16/2/2005 |

| 2008 | 400 | Bonus issue of 1:1, 8/8/2008 |

| 2008 | 4000 | Split from 10 to 1, 8/8/2008 |

Major Domestic Investors:

| Shareholders | % Held |

| LIC | 6.4 |

| ICICI Prudential | 5 |

| HDFC Infrastructure Fund | 2.5 |

| SBI Arbitrarge Fund | 1.1 |

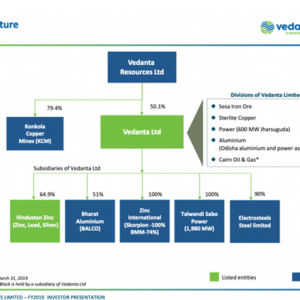

Group Structure:

The zinc business under its subsidiary HZL remains the highest cash-generating business.

Buyback:

The company plans to delist itself from the stock exchanges and in turn become private. (https://www.bseindia.com/xml-data/corpfiling/AttachHis/d8db546e-c273-45bb-91e7-7d27181f847b.pdf)

The Indicative price which is the floor price is quoted at Rs. 87.5 per share to buyout the 49% of the holdings which will fetch Rs 16200 crs (185 crs shares * Rs. 87.5) mainly to repay debt in the medium term and for corporate simplification purpose. Delisting will provide enhanced operational and financial flexibility.

The buyback is supposed to be carried out by a process of reverse book building.

The final price will be decided by the merchant bankers (Reverse book building process) if there is no voting for delisting of more than 75% and it will go in the second tranche of process.

The current debt is $7 billion with $1.9 billion maturing in the next 12-15 months.

Experts believe that it is company’s move to lap up the shares at such a low cost from the minority shareholders.

Vedanta Resources’ inefficient corporate structure and dependence on dividends from Vedanta Ltd for debt servicing have constrained its credit profile

A successful privatization of Vedanta would improve Vedanta Resources’ access to the subsidiary’s cash flows. This will be due to more efficient dividend upstreaming (compared to about 50 per cent that is currently paid to minority shareholders).

The stock is available at 50% of the 52 week high, hence this would be a perfect opportunity for Anil Agarwal to exercise the buyback. The Board of directors have decided to meet on the 18th of May to consider the offer.

Vedanta wants to delist at cyclical lows, but investors may not budge. (https://www.livemint.com/market/mark-to-market/vedanta-wants-to-delist-at-cyclical-lows-but-investors-may-not-budge-11589471491854.html)