https://www.bseindia.com/markets/MarketInfo/DispNewNoticesCirculars.aspx?page=20200804-42

1. Scrip code : 501111

Name : Gold Rock Investments Ltd.

Subject : NCLT Order Dated July 24, 2020 Has Sanctioned The Scheme Of Amalgamation Under Section 230 To 232

Pursuant to Regulation 30 and 33 of Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015 we would like to inform you that the Board of Directors of the Company at its meeting held today i.e. on Friday, July 31, 2020 inter alia:5. Considered and update the NCLT order dated July 24, 2020 has sanctioned the Scheme of Amalgamation under Section 230 to 232 and other applicable provisions of the Companies Act, 2013 between seven wholly owned subsidiaries of Gold Rock Investments Limited viz. (i) Blue Point Leasings Limited; (ii) Gold Rock Metals Limited; (iii) Sugata Investments Limited; (iv) Gold Rock World Trade Limited; (v) Gold Rock Agro-Tech Limited (vi) Picanova Investments Private Limited; (vii) Tridhar Finance and Trading Limited; (collectively “Transferor Company”) and Gold Rock Investments Limited (Transferee Company)

2. Scrip code : 542323

Name : K.P.I. Global Infrastructure Limited

Subject : Intimation Of Terminating 213.75 KW Solar Power Plant Under Captive Power Producer (‘CPP’)

KPI Global Infrastructure Limited has informed BSE that it has have received the request letter from M/s. Govindam Knit Fab, Surat for terminating 213.75 Kw Solar Power Plant under ‘Captive Power Producer (CPP)’ segment of the Company. The Company has accepted the termination. Disclosure is attached herewith.

3. Scrip code : 539551

Name : Narayana Hrudayalaya Limited

Subject : News About MMI Narayana Multispecialty Hospital, Raipur In An IBC24 Hindi News Channel

News about MMI Narayana Multispecialty Hospital, Raipur in an IBC24 Hindi News Channel

4. Scrip code : 526371

Name : NMDC Ltd

Subject : Prices Of Iron Ore W.E.F. 31-07-2020

Sub: Prices of Iron Ore w.e.f. 31-07-2020 – Reg Kindly note that the prices of Iron Ore w.e.f. 31-07-2020 has been fixed as under: i) Lump Ore (65.5%, 6-40mm) @ Rs. 2,650/- per ton ii) Fines (64%, -10mm) @ Rs. 2,360/- per ton Note: The above FOR prices are excluding Royalty, DMF, NMET, Cess, Forest Permit Fee and other taxes.

5. Scrip code : 513262

Name : Steel Strips & Wheels Ltd

Subject : SSWL Receives New Orders For Over USD 1.3 Mn From US

SSWL is glad to inform that it has bagged firm export orders for over 116,000 wheels for US Caravan Trailer Market to be executed in the month of October from its Chennai plant. Inflow of more orders is expected to come from various other customers as the market gains stability. Production at the Chennai steel wheel plant will further ramp up with such developments.

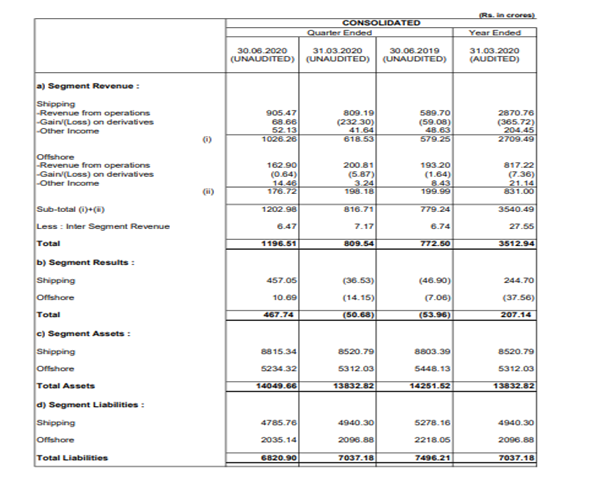

Source : Company Results

Source : Company Results