Daily Bulletin (18th October, 2021)

https://www.bseindia.com/markets/MarketInfo/DispNewNoticesCirculars.aspx?page=20211018-40

Scrip code : 539562

Name : AARNAV FASHIONS LIMITED

Subject : Announcement under Regulation 30 (LODR)-Scheme of Arrangement

In furtherance to our letter dated September 29, 2021, this is to inform that in accordance with direction of Hon’ble National Company Law Tribunal, Ahmedabad Bench dated September 27, 2021, a meeting of Equity Shareholders of the Company will be held on Wednesday, November 17, 2021 at 2.00 P.M. (IST) at Survey No. 302, Isanpur, Narol, Ahmedabad – 382 405, Gujarat, India to consider and if thought fit, to approve the Scheme of Arrangement. The copy of Notice along with explanatory statement is enclosed herewith. Due to size restriction, the copy of Notice of meeting is enclosed herewith. Further, the Notice along with all annexures is also available on the website of the Company at www.aarnavgroup.com. Kindly take this on your record and disseminate.

Scrip code : 720723

Name : BEML Ltd

Subject : Announcement under Regulation 30 (LODR)-Scheme of Arrangement

Receipt of Observation letter from NSE in relation to Scheme of Arrangement for Demerger between BEML Limited and BEML Land Assets Limited and their Respective Shareholders and Creditors.

Scrip code : 530427

Name : Choksi Imaging Ltd.

Subject : Announcement under Regulation 30 (LODR)-Public Announcement-Open Offer

The Company is in receipt of Copy of Corrigendum to the Detailed Public Statement pertaining to Open Offer being made by Mr. Samir Choksi and M/s. Choksi Asia Private Limited. A copy of Corrigendum to the Detailed Public Statement is enclosed for your reference and records.

Scrip code : 532960

Name : Dhani Services Limited

Subject : Board Meeting Intimation for Intimation Of Meeting Of The Board Of Directors As Per Regulation 29 Of Securities And Exchange Board Of India (Listing Obligations And Disclosure Requirements) Regulations, 2015, To Consider Raising Of Funds

Dhani Services Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 20/10/2021 ,inter alia, to consider and approve Pursuant to Regulation 29(1)(d) and 29(2) of the Securities Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015, as amended (‘SEBI Listing Regulations’), this is to inform you that a meeting of the Board of Directors of the Company is scheduled to be held on Wednesday, October 20, 2021, inter alia, to consider and approve raising of funds, through issue of equity securities and/or any other convertible or exchangeable securities, by way of a preferential offer and pricing thereof, subject to the approval of the members of the Company, and other regulatory and/or statutory approvals, as applicable. (for detail refer attachment)

Scrip code : 532922

Name : Edelweiss Financial Services Ltd.

Subject : Announcement under Regulation 30 (LODR)-Diversification / Disinvestment

This is in continuation to our letter dated July 2, 2021 regarding acquiring of stake in Edelweiss Gallagher Insurance Brokers Limited (EGIBL), a subsidiary of the Company, by Arthur J. Gallagher & Co. (“AJG’). On receipt of the necessary approvals, the Company, has in the first tranche, transferred 61% of the stake held by the Company in EGIBL to AJG on October 18, 2021. Consequently, AJG now owns 91% of EGIBL, as a result of which EGIBL has ceased to be the subsidiary of the Company.

Scrip code : 526729

Name : Goldiam International Ltd.

Subject : Buyback Offer

Keynote Financial Services Ltd (“Manager to the Buyback Offer”) has submitted to BSE a copy of Public Announcement for the attention of the Equity Shareholders/Beneficial Owners of Equity Shares of Goldiam International Ltd (“Target Company”) for Buyback of Equity shares through tender offer under the Securities and Exchange Board of India (Buy-Back of Securities) Regulations, 2018, as amended.

Scrip code : 531449

Name : GRM Overseas Ltd.

Subject : Intimation Under Regulation 30 Of SEBI (Listing Obligations And Disclosure Requirements) Regulations, 2015 (‘Listing Regulations’) For Appointment Of Mr. Sanjeev Dar As Chief Operating Officer (COO)- Consumer Staple Business Of GRM Foodkraft Pvt. Ltd, A Subsidiary Of GRM Overseas Ltd. Pursuant to the provisions of Regulation 30 read with Schedule III of the Listing Regulations, please be informed that Mr. Sanjeev Dar has been appointed as Chief Operating Officer (COO)- Consumer Staple Business of GRM Foodkraft Pvt. Ltd, a subsidiary of GRM Overseas Ltd, w.e.f. 18th October, 2021. He will be looking after the Sales & Marketing, Business Development, commercial & go-to-market strategies and Supply chainof the Subsidiary.

Scrip code : 500183

Name : HFCL LIMITED

Subject : Approval Of Application Under The Production Linked Incentive (PLI) Scheme To Promote Telecom And Networkingproducts Manufacturing In India, Filed By HFCL Technologies Private Limited, A Wholly-Owned Subsidiary Of HFCL Limited (“Company”)

We would like to inform all our stakeholders that in order to take the benefits of the Performance Linked Incentive Scheme for Telecom and Networking Products, notified by the Ministry of Communications (Department of Telecommunications), Government of India, the Company”s wholly owned subsidiary namely HFCL Technologies Private Limited had made an application with Small Industries Development Bank of India (SIDBI), Project Management Agency (PMA) and Competent Authority appointed under the PLI Scheme. We are pleased to inform all our stakeholders that SIDBI vide its letter no. PLI/PLI/GSCV /OUT/11964/ND3 dated October 14, 2021 has conveyed approval of the above mentioned application made by HFCL Technologies Private Limited, for availing the benefits of the PLI Scheme, under Non-MSME (Domestic) category. HFCL Technologies Private Limited is one of the 31 entities which has been granted approval under PLI Scheme for manufacturing of Telecom and Networking Products in India.

Scrip code : 536868

Name : Integra Telecommunication & Software Limited

Subject : Intimation Of Sale Of Shares By Micro Logistics (India) Private Limited

Dear Sir / Madam, Pursuant to provision of Regulation 30 of Securities Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulation, 2015. Please note that Micro Logistics (India) Private Limited, Promoter Entity, has informed the Company that it has sold 10,53,833 equity shares of the Company in open market between October 11, 2021 to October 14, 2021 in multiple lots. The requisite disclosure under SEBI (Prohibition of Insider Trading) Regulations, 2015 and SEBI (Substantial Acquisition of Shares and Takeovers) Regulation, 2011 has been separately filed with the Stock Exchange. Kindly take the same on your records.

Scrip code : 531726

Name : Panchsheel Organic Ltd.

Subject : Boards recommends Bonus issue

Panchsheel Organics Ltd has informed BSE that the Board of Directors of the Company at its meeting held on Oct 16, 2021, inter alia has approved the following: – Recommendation of issuance of fully paid Bonus Shares in the ratio of 1:1 i.e. 1 fully paid up share for every 1 fully paid up equity shares held, subject to approval of the members and other necessary approvals as may be necessary.

Scrip code : 517506

Name : TTK Prestige Ltd.

Subject : Board to consider Sub-Division of Equity Shares

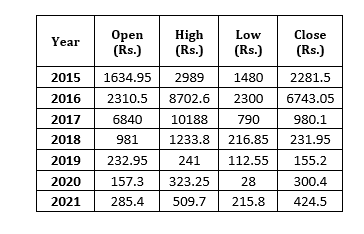

In addition to the earlier letter dated September 20, 2021 to consider Un-audited Financial Results for the quarter and half year ended September 30, 2021, TTK Prestige Ltd has now informed BSE that an additional agenda item is to be included in the notice of the meeting of the Board of Directors of the Company scheduled to be held on October 27, 2021 as under: – To consider matters related to sub-division/split of Equity Shares of face value of Rs.10/- each of the Company in such manner as the Board may determine including matters related/ incidental thereto and any other matter as the Board of Directors may decide during the course of the meeting. As informed earlier vide the Company’s communication dated September 20, 2021, the Trading Window for dealing in the Company’s securities, as required under the Code of SEBI (Prohibition of Insider Trading) Regulation, 2015 was closed from October 01, 2021 till October 29, 2021.

On 14 Sept, 2017 there was a stock split from Rs. 10 to Rs. 1

On 14 Sept, 2017 there was a stock split from Rs. 10 to Rs. 1