Cochin Shipyard

Shipping

FV – Rs 10; 52wks H/L – 491.15/209; TTQ – 0.76 Lacs; CMP – Rs 318.8 (As On June 26, 2020);

Market Cap – Rs 4194 Crs

Consolidated Financials and Valuations (Amt in Rs Crs unless specified)

| Cochin Shipyard | ||||||||||

| Year | Equity | Net Worth | Long Term Debt | Total Sales | PAT | BV | EPS | P/E | P/BV | Promoter’s Holdings |

| Rs Cr. | Rs Cr. | Rs Cr. | Rs Cr. | Rs Cr. | Rs | Rs | % | |||

| 2019-2020 | 132 | 3723 | 123 | 3422 | 632 | 283.02 | 48.05 | 6.64 | 1.13 | 72.86 |

| 2018-2019 | 132 | 3329 | 123 | 2966 | 478 | 253.05 | 36.32 | 8.78 | 1.26 | 75 |

Board of Directors:

Madhu S Nair: Chairman & Managing Director

Shri D Paul Ranjan: Director (Finance) and Chief Financial Officer

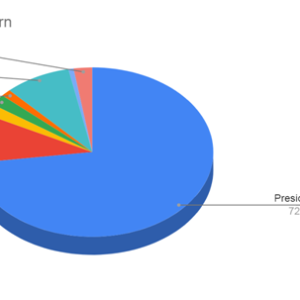

Shareholding Pattern:

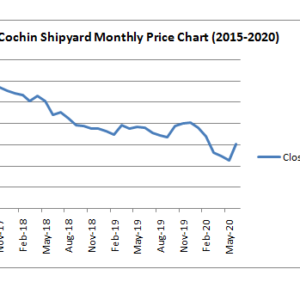

Price History:

Peer Comparison:

(All figures inRs Cr. unless specified)

| Cochin Shipyard | Garden Reach | LP Naval | |

| Price (Rs) | 318.8 | 209.6 | 61 |

| FV (Rs) | 10 | 10 | 10 |

| Market Cap | 4194 | 2412 | 35 |

| Equity | 132 | 115 | 6 |

| Net Worth | 3723 | 1040 | 12 |

| Total Debt | 123 | 0 | 13 |

| Sales | 3422 | 1433 | 21 |

| Net Profit | 632 | 163 | 2 |

| EPS (Rs) | 48.0 | 14.3 | 2.9 |

| BV (Rs) | 283.0 | 90.8 | 21.7 |

| PE | 6.6 | 14.7 | 20.8 |

| PB | 1.1 | 2.3 | 2.8 |

Buyback:

On October 31, 2018, The board announced a buyback of Rs. 200 Cr at Rs 455 per share.

The company decided to buyback 43,95,610 shares which would add up to 6.41% of the total equity.

Buyback Details:

All figures inRs Cr. unless specified

| Company | FV (Rs) | No of Shares | Buyback price (Rs) | Buyback Type | Date | Stake | Value | Equity Pre | Equity Post | Networth Pre | Networth Post |

| Cochin Shipyard | 10 | 4395604 | 455 | Tender Offer | 16 Oct 18 | 6.41% | 200 | 135.9 | 131.5 | 3618 | 3462 |