BF Utilities

Market Cap: Rs 945 Crs

52 Week High/ Low: Rs 361/134

Results:

| 17/07/2020 |

BF Utilities |

|||||||||||

| Year | FV | CMP | Equity Capital | Net Worth | Long Term Debt | Total Sales | PAT | BV | EPS | P/E | P/BV | Promoter’s Holdings |

| 2020 Standalone |

5 |

250 | 18.83 | 130.51 | 3.7 | 23.76 | 2.51 | 34.7 | 0.7 | 375.1 | 7.2 | 55.99 |

| 2019 Standalone |

5 |

250 | 18.83 | 128.1 |

7 |

49.8 | 27.16 | 34.0 | 7.2 | 34.7 |

7.3 |

|

| 2019 Consolidated |

5 |

250 | 18.83 | -59.3 | 1660.8 | 469.3 | 71.9 | -15.7 | 19.1 | 13.1 |

– |

|

|

2018 Consolidated |

5 | 250 | 18.83 | -98.7 | 1580 | 411.6 | 36 | -26.2 | 9.6 | 26.2 | – | |

The consolidated statements for 2020 are yet to be issued

Standalone Segment Earnings:

| 2020 | Revenue |

| Infrastructure | 0.77 |

| Wind Power | 19.25 |

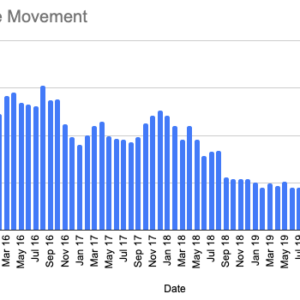

5 Year Historical Price Movement:

BF Utilities is an Indian Holding company belonging to the Kalyani group with investments in Infrastructure and Wind Power Generation.

Its wind farm project consists of approximately 50 wind energy generators of over 230 kilowatts and approximately 10 WEGs of over 600 kilowatts.

Its subsidiaries include:

Nandi Infrastructure Corridor Enterprise Limited (NICE): NICE has an interest in the Bangalore Mysore Infrastructure Corridor Project, which is an infrastructure development project. BMIC Project consists of over 40 kilometres Outer Peripheral Road and over 10 kilometres Expressway up to Bidadi.

Nandi Highway Developers Limited: NHDL has built and operates over 30 kilometres bypass road connecting the twin cities of Hubli and Dharwad in North Karnataka

Avichal Resources Pvt. Ltd.

Recent News:

Investor Radhakishan Damani picked up a 1.3% stake (491000 shares) in the June quarter.