https://www.bseindia.com/markets/MarketInfo/DispNewNoticesCirculars.aspx?page=20200811-35

1. Scrip code : 506260

Name : Anuh Pharma Ltd.

Subject : Corporate Action-Board recommends Bonus Issue

Pursuant to the provisions of Regulation 30 read with Schedule III of the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015, this is to inform you that the Board of Directors of the Company (the “Board”) at its Meeting held today i.e. Friday, 7th August, 2020, inter-alia considered and approved Issue of Bonus Equity Shares in the ratio of 1:1 i.e. 1 (One) equity share of face value of Rs. 5/- each for every existing 1 (One) equity share of face value of Rs. 5/- each fully paid up by way of capitalization of Free Reserves subject to approval of the Members. The Bonus shares shall be allotted rank pari-passu in all respect and carry the same rights of the existing equity shares.

2. Scrip code : 505200

Name : Eicher Motors Ltd.

Subject : Corporate Action-Outcome of Sub division / Stock Split

Approval of shareholders inter alia to the sub-division of equity shares of the Company

3. Scrip code : 532440

Name : MPS Limited

Subject : Corporate Action-Buy back

Buyback of fully paid up Equity Shares of face value of INR 10 each not exceeding 5,66,666 Equity Shares (representing 3.04% of the total paid-up equity share capital of the Company as on March 31, 2020) at a price of INR 600 per Equity Share payable in cash for an aggregate amount not exceeding INR 34,00,00,000, excluding taxes payable under Income Tax Act, 1961 and expenses to be incurred for the buyback like transaction costs viz. brokerage, securities transaction tax, GST, stamp duty, etc., which is 9.95% and 9.49% of the fully paid-up equity share capital and free reserves as per the latest audited standalone and consolidated balance sheet of the Company for the financial year ended March 31, 2020, respectively, on a proportionate basis from the shareholders of the Company, through the “Tender Offer” route using mechanism for acquisition of shares through stock exchange as prescribed under SEBI Buy Back Regulations and the Companies Act, 2013 and rules made thereunder.

4. Scrip code : 500179

Name : HCL Infosystems Ltd

Subject : Intimation Of Board Approval Of HCL Infosystems Limited For Merger Of Wholly Owned Subsidiaries With The Company

In terms of Regulation 30 read with Part A of Schedule III as per SEBI (LODR) Regulations, 2015, we wish to inform you that the Board of Directors of HCL Infosystems Limited (‘the Company’), in their meeting held today i.e. 6th August, 2020 has considered and given its approval for the following – The Board considered and approved merger of HCL Learning Limited and DDMS with the Company. HCL Learning Limited and DDMS are wholly owned subsidiaries of the Company. The proposed merger is for the purpose of simplifying and streamlining the group structure of the Company and reduce administrative costs. The proposed merger shall be implemented through a scheme of amalgamation under the provisions of Section 230 to 232, and other applicable provisions of the Companies Act, 2013 and shall be subject to the approvals of National Company Law Tribunal, shareholders and creditors of the Company and such other approvals as may be required in this regard.

5. Scrip code : 534675

Name : Prozone Intu Properties Limited

Subject : Intimation Of Scheme Of Amalgamation Between Two Wholly Owned Subsidiary Companies

Please be informed that the Board of Directors of the Company has approved the Scheme of Amalgamation (‘Scheme’) of Royal Mall Private Limited (‘Amalgamating Company’) with Prozone Developers & Realtors Private Limited (‘Amalgamated Company’) under Sections 230 to 232 and other relevant provisions of the Companies Act, 2013. Both Companies i.e. Amalgamating Company and Amalgamated Company are wholly owned subsidiaries of the Company and have approved the Scheme in their respective Board Meetings. The appointed date of the Scheme is 1st January 2020. Since the proposed amalgamation is between two wholly-owned subsidiaries, right of the Company and its stakeholders are not going to be affected by the virtue of this Scheme. This information is being disseminated under regulation 30 of SEBI (LODR) Regulations 2015 and other application provisions.

6. Scrip code : 532779

Name : TORRENT POWER LIMITED

Subject : Notice Of NCLT Convened Meeting Of Unsecured Creditors Of Cable Business Undertaking Of The Company Through Video Conferencing / Other Audio Visual Means (‘VC / OAVM’) On Tuesday, September 15, 2020

Notice of NCLT convened Meeting of Unsecured Creditors of Cable Business Undertaking of the Company through Video Conferencing / Other Audio Visual Means (‘VC / OAVM’) on Tuesday, September 15, 2020 for considering and if thought fit, to approve the proposed Scheme of Arrangement between Torrent Power Limited (hereinafter referred to as the Transferor Company’) and TCL Cables Private Limited (hereinafter referred to as the ‘Transferee Company’) and their respective shareholders and creditors for transfer and vesting of the Cable Business Undertaking of Torrent Power Limited to TCL Cables Private Limited by way of slump sale, under Sections 230-232 and other applicable provisions of the Companies Act, 2013.

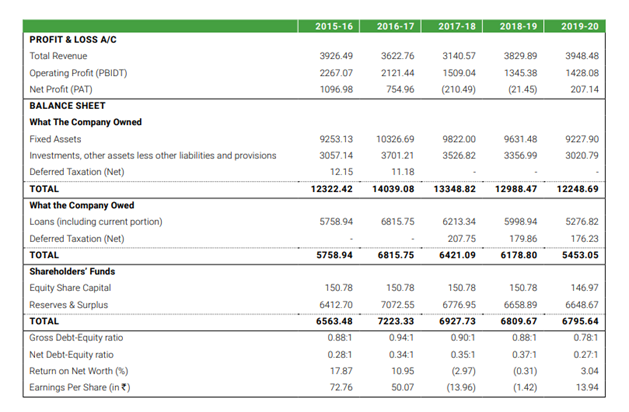

Source : Company Results

Source : Company Results