https://www.bseindia.com/markets/MarketInfo/DispNewNoticesCirculars.aspx?page=20200703-31

1. Scrip code : 532369

Name : Ramco Industries Ltd

Subject : Announcement under Regulation 30 (LODR)-Acquisition

The Company has invested Rs.2.50 Crores in the Capital of Lynks Logistics Limited by way of subscribing to 2.50 Crores equity shares of Re.1/- each, through their Rights Issue. Consequent to the investment, the total shareholding of our Company in Lynks Logistics Limited is 20,19,00,000 shares of face value of Re.1/- each constituting 22.05% of its paid up share capital. The disclosure required under Para A of Part A of Schedule III of SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 read with SEBI Circular CIR/CFD/CMD/4/2015 dated September 9, 2015 is enclosed. We request you to kindly take the above on record.

2. Scrip code : 542752

Name : Affle (India) Limited

Subject : Announcement under Regulation 30 (LODR)-Acquisition

This is to inform that Affle International Pte. Ltd., a wholly-owned Singapore subsidiary of the Company has entered into a definitive Share Subscription Agreement to acquire 8.0% ownership in OSLabs Pte. Ltd. incorporated in Singapore (‘Indus OS’)

3. Scrip code : 536507

Name : Future Lifestyle Fashions Limited

Subject : Future Lifestyle Fashions Ltd reply to clarification sought by the exchange

The Exchange had sought clarification from Future Lifestyle Fashions Ltd with respect to news article appearing on www.economictimes.indiatimes.com June 30, 2020, titled “Reliance Industries nears deal to acquire retail businesses of Future Group”. Future Lifestyle Fashions Ltd response is enclosed.

4. Scrip code : 500850

Name : Indian Hotels Co. Ltd

Subject : Announcement under Regulation 30 (LODR)-Acquisition

In terms of Regulation 30 of Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015, we would like to inform you of the following acquisition: 1. Taj Cape Town Hotel in Cape Town, South Africa, is owned by a South African wholly owned subsidiary (WOS) of IHMS Hotels (SA) Pty Ltd (IHMS). IHMS is a 50:50 joint venture between Ihoco BV (Ihoco), an overseas WOS of The Indian Hotels Co Ltd (IHCL), and Tata Africa Holdings (SA) Pty Ltd (TAH), an overseas subsidiary of Tata International Ltd. 2. Ihoco and TAH have executed a definitive agreement for Ihoco’s acquisition of the following investments of TAH in IHMS: a) The entire 50% holding of TAH in the shares of IHMS and b) The shareholder loans advanced by TAH to IHMS. 3. The transaction price is US$ 1 million. The final consummation of the transactions under the agreement is subject to certain regulatory approvals in South Africa. As a consequence, IHMS will become a WOS of Ihoco.

5. Scrip code : 540768

Name : Mahindra Logistics Limited

Subject : Announcement under Regulation 30 (LODR)-Acquisition

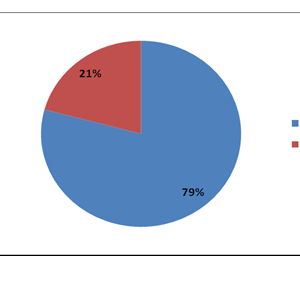

In compliance with Regulation 30(6) read with Schedule III and other applicable provisions of the Listing Regulations, we hereby inform you that the Investment Committee of the Board of Directors of Mahindra Logistics Limited (‘the Company’), at their Meeting held today viz. Saturday, 27 June 2020, have, inter-alia, approved further investment in Lords Freight (India) Private Limited, Subsidiary Company (‘Lords’) by way of purchase of 3,80,970 equity shares of Lords (representing 16.13% of equity share capital of Lords) from the existing promoter shareholders of Lords. We further inform you that presently the Company holds 82.92% of the share capital of Lords and on completion of the transfer formalities of said 3,80,970 equity shares of Lords, the Company’s shareholding in Lords would increase by 16.13%. Detailed disclosure as required under Regulation 30(6) read with Schedule III of the Listing Regulations & the SEBI Circular CIR/CFD/CMD/4/2015 dated 9 September 2015 is attached.

6. Scrip code : 531642

Name : Marico Limited

Subject : Announcement under Regulation 30 (LODR)-Acquisition

This is further to the intimation filed by the Company on March 17, 2017 informing about the investment by the Company in Zed Lifestyle Private Limited (‘the Investee Company’) equivalent to 45% of the issued and paid-up share capital of the Investee Company. The Company has now acquired the balance equity stake of 55% in the Investee Company from its existing shareholders. kindly take the above on record.

7. Scrip code : 532440

Name : MPS Limited

Subject : Announcement under Regulation 30 (LODR)-Acquisition

The Board in its meeting held today (i.e. July 1, 2020) considered and approved the purchase of 100% shares of HighWire Press Limited based at Northern Ireland by its wholly owned subsidiary company MPS North America LLC , USA. This acquisition will be done as per the Stock Purchase Agreement to be executed between MPS NA LLC and HighWire UK Holdings LLC, USA (‘Seller’). The Seller holds 100% of the NI Entity. NI Entity also owns 100% shareholding of Semantico Limited (‘UK Entity’). This acquisition is being done at a purchase price of USD 1,000,000. 2. The Board in its meeting held today (i.e. 1st July, 2020) also considered and approved to acquire the US business of HighWire Press, Inc. for a consideration of USD 6,100,000. The acquisition will be completed through the Company’s US branch and newly incorporated wholly owned subsidiary in Delaware, USA, HighWire North America LLC and to invest as initial capital up to USD 250,000 in HighWire NA LLC.

8. Scrip code : 531364

Name : PARAMONE CONCEPTS LIMITED

Subject : Announcement under Regulation 30 (LODR)-Acquisition

Acquisition of 19.52% stake of ‘M/s. Jaatvedas Construction Co. Pvt Ltd.

9. Scrip code : 532369

Name : Ramco Industries Ltd

Subject : Announcement under Regulation 30 (LODR)-Acquisition

The Company has invested Rs.2.50 Crores in the Capital of Lynks Logistics Limited by way of subscribing to 2.50 Crores equity shares of Re.1/- each, through their Rights Issue. Consequent to the investment, the total shareholding of our Company in Lynks Logistics Limited is 20,19,00,000 shares of face value of Re.1/- each constituting 22.05% of its paid up share capital. The disclosure required under Para A of Part A of Schedule III of SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 read with SEBI Circular CIR/CFD/CMD/4/2015 dated September 9, 2015 is enclosed. We request you to kindly take the above on record.