UNION BUDGET 2021

Borrow and Monetize to Grow

bseindia.com

“100 years of India wouldn’t have seen a Budget being made post-pandemic like this”

This was the promise made by Finance Minister Mrs Nirmala Sitharaman on December 18,2020.Did she deliver yesterday ?

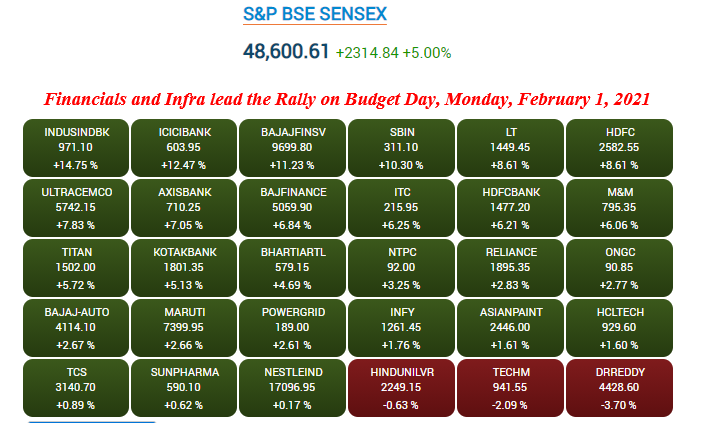

Well for one,it was a historic paperless budget ! and the Sensex cheered her all the way as the Markets viewed ‘no negatives as a positive’ as she announced a strong Infrastructure thrust to be funded by borrowing and monetisation of assets .There was neither any ‘Covid Tax’ as feared nor was there any increase in Direct Taxation rates.It was a relief rally in a sense for Markets had turned jittery after a record 50184 level on January 21,2021.Last week Foreign Portfolio Investors (FPIs) had reversed their record inflows of past few months , selling Equity on each of the four trading days to aggregate Rs 6698 crs or US $ 918 m outflows for the week.Budget Day yesterday they were back buying Rs 1494 crs worth again quelling some concern that outflows would continue.

The Buoyancy should remain this week but so should the Volatility going forward for Intent has been announced but Implementation and Execution are yet to be seen

Here’s at least 10 reasons why the Markets Cheered all the way

- No Negatives ~ Direct Taxation was largely left untouched ~ No Covid Tax

- Major Thrust on Infrastructure with a setting up of a Development Financial Institution with a starting capital of Rs 20000 crs and which would facilitate raising Rs Five Lakh Crores over the next Five Years for Infrastructure Projects in Roadways,Power,Ports,Shipping ,Airports

- Disinvestment and Strategic Sales of BPCL,Air India,Concor,Shipping Corporation of India,Bharat Earth Movers,Pawan Hans,and IDBI Bank in FY 22.Target is Rs 175000 crs . IPO of LIC to be completed in FY 22

- Steps to make India a global manufacturing hub in five years

- Monetisation of Land owned by Government and Public Sector Units

- Two PSU Banks and One General Insurance Company to be identified for Privatisation ~ All Banks simply took off on the Bourses

- FDI Cap raised in Insurance from 49% to 74 % with Foreign Control subject to some safeguards

- Announcement of a Voluntary Scrappage Policy for Vehicles

- Plan to set up Asset Reconstruction and Asset Management Holding Companies to take over stressed assets of Public Sector Banks thus aggregating these assets for faster resolution and realisation of such assets by experts

- National Monetization Pipeline of potential brownfield infrastructure assets (comprising of assets from NHAI, PGCIL, Dedicated Freight Corridor, Airports, Warehousing Assets, Sports Stadia) to be launched

Here’s our Quick Budget Take and what we think you should be aware of

We always re-iterate there are seven ways to raise Capital

| Increasing Income | Reducing Expenditure | Raising Equity | Borrowing |

| Sellling Assets | Printing Currency | Stealing | |

Well, Stealing or Theft is certainly not what a Country can do ! but the other six options certainly can be exercised.Post Budget our FM has revealed that neither raising Taxes nor printing currency was on the table .Her Budget reveals the twin approach of Increased Borrowings and Asset Monetisation to raise Capital .

Budget at a Glance (Annexure 1 Sr 7) and Sources of Financing Fiscal Deficit (Annexure 2 Sr 8 ) show Borrowings rocket up Rs 1052318 crs in FY 21 from Budget Estimates of Rs 796337 crs to Revised Estimates of Rs 1848655 crs ~ that’s a 132% increase ! For FY 22 the Budget Estimates are Rs 1506812 crs .These Borrowing are the Fiscal Deficit which for FY 21 is 9.5% of the revised FY 21 GDP of Rs 19481975 crs (just a -4.2% de-growth) and for FY 22 is 6.8% of the FY 22 GDP of Rs 22287379 crs ( 14.4 % GDP growth)

FY 22 Disinvestment Proceeds of Rs 175000 crs are shown in Budget at a Glance ( Annexure 1 Sr 6) and Receipts (Annexure 3 Sr 3A(ii) ) whch also show the significantly downward revised FY 21 proceeds at Rs 32000 crs against earlier Rs 210000 crs estimated

While resorting to the Borrowing Route would raise concern,it must be observed that in an era of low and even negative interest rates ,India would be able to raise debt at attractive interest rates despite it’s BBB- Credit Ratings by both Standard & Poor’s and Fitch.

The concern does remain though on the proportion of application of such borrowings to Capital Expenditure of which the narrative of the Government and a lot of ‘Yes’ Experts has been over-complimentary

Here’s the Proportion of Capex to Borrowings as extracted from Budget at a Glance (Annexure 1)

| Ref in Annexure 1 | In Rs Crs | BE FY 21 | RE FY 21 | BE FY 22 |

| Sr 7 | Borrowings | 796337 | 1848655 | 1506812 |

| Sr 12 | Grants in Aid for Creation of Capital Assets | 206500 | 230376 | 219112 |

| Sr 13 | Expenditure on Capital Account | 412085 | 439163 | 554236 |

| Total Capex | 618585 | 669539 | 773348 | |

| % to Borrowings | 78 | 36 | 51 |

In our view the comfort level of the Government for such a huge scale of Borrowings comes from what appears to be an understatement of both Tax Revenues (underplaying Tax Buoyancy) as well as Disinvestment Proceeds as observed in Receipts (Annexure 3) . The Disinvestment Target of Rs 175000 crs is actually an aggregation of Rs 75000 crs Disinvestment Receipts and Rs 100000 crs through sale of Government Stake in Banks and Financial Institutions.In our View the embedded value of LIC is huge and even a 10% stake sale by the Government will garner much more than Rs 175000 crs

Post Budget the FM exclaimed in a TV Interview “We’ve Spent,We’ve Spent ,We’ve Spent!” ~ Refer to Annexure 4 for Expenditure reference .She might have also expressed “We’ve Borrowed,We’ve Borrowed,We’ve Borrowed !” or “ We’ve Sold, We’ve Sold,We’ve Sold !” to convey the adoption of Borrowing and Asset Monetisation to raise Capital,the latter remark probably conceding the Government has failed to manage most PSUs efficiently and it has no business to be in business.

Conclusion

Our major concern remains Inequality and Income Skewness in that all of India will not be carried up together as our Economy bounces back. While thrust on Infrastructure is much welcome, the huge fiscal deficit and thus the unprecedented scale of borrowings raises a Caution if we don’t see the desired outcome in the coming years of Income, Revenue and Employment Generation fall in place. The FRBM had envisaged 3% fiscal deficit this year.With the Economy slowing down even before the pandemic arrived last year, the fiscal deficit was never going to be down to 3% .FY 21 it’s 9.5%.FY 22 it’s targeted at 6.8% and the FM says by FY 25 it should be 4.5%.So a US $ Five Trillion Economy is set back a few years more than by FY 25 .Even a fear of a few cornering the proposed monetization of assets through disinvestment, privatization and sale of land is not misplaced

Those who will continue benefiting from Stock Market Surges are but a small percentage of the population who invest in Equities. The Penetration is in low single digit %

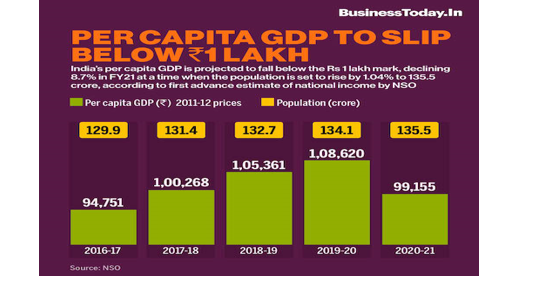

Here’s the current reality of our per capita dropping below Rs One lakh .This should revive back in FY 22

Financials, Infra plays , Metals are potentially rewarding themes in FY 22 and if you can zone in on which two PSU Banks and General Insurance Company are to be privatized as announced by the FM in the Budget ,you’ve got winners in your portfolio. Keep a keener eye on Corporate Earnings to confirm a V Shaped Recovery and on FPI Flows which determines market trends .2021 is going to very interesting

Cheers,

Gaurav Parikh, Managing Director

[email protected] +91-9820162597

Disclosure & Disclaimer

Jeena Scriptech Alpha Advisors Pvt Ltd (JSAAPL) is a SEBI Registered Entity offering Fundamental Direct Equity Research Analysis, Equity Portfolio Advisory, Training & Mentoring Services in Capital Markets

This Report is under our free access SCRIP STANDPOINT Module.It is for the personal information of the recipient/reader. We are not soliciting any action based upon it. This report is not to be construed as an offer to sell or the solicitation of an offer to buy any security in any jurisdiction. It is our Viewpoint for general information purposes only. It does not take into account the particular investment objectives, financial situations, or needs of individuals & other entities .We have reviewed the report, and in so far as it includes current or historical information, it is believed to be reliable though its accuracy or completeness cannot be guaranteed. Neither JSAAPL, nor any person connected with it, accepts any liability arising from the use of this document. The recipients of this material should rely on their own investigations and take their own professional advice. Opinions expressed are our current opinions as of the date appearing on this material only. No part of this material may be duplicated in any form and/or redistributed without JSAAPL’s prior written consent. In case you require any clarification or have any concern, kindly write to us at: [email protected]

|