LIC IPO DRHP ~ QUICK FIRST TAKE

Computed Price Range of Rs 2000 to Rs 2200 puts it in TOP 3 Market Cap Companies

Life Insurance Corporation of India (LIC) has just filed its 652 Pages Draft Red Herring Prospectus (DRHP) with SEBI today, Sunday, February 13,2022. It is on track for an IPO in March 2022

Our Quick First Take is as below :

| Equity | Rs 6325 Crs comprising of 6,324,997,701 Equity Shares of face Value Rs 10 owned 100% by Government of India |

| IPO Offer For Sale by Govt | 316,245,889 Equity Shares comprising 5% of the Equity |

| Special Quota | LIC Policy Holders 10 % : Employees 5% ~ may offer both at a discount on IPO Price |

| LIC Embedded Value | Rs 5,39,686 crs as on September 30,2021 |

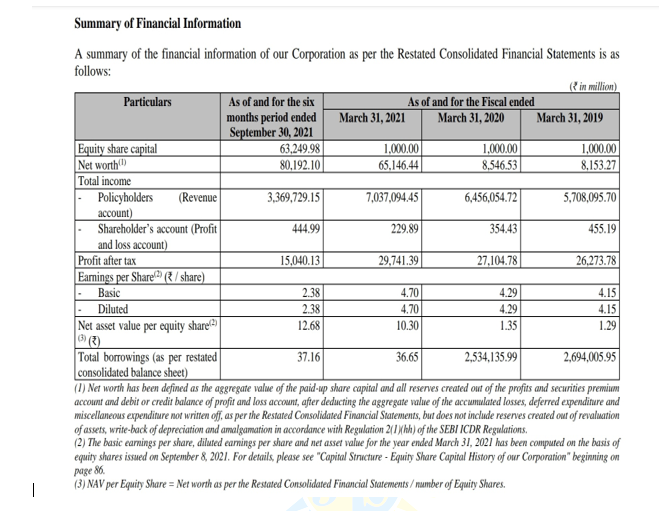

| NAV/Share | Rs 12.68 as on September 30,2021 based on relevant Networth of Rs 8020 crs |

| EPS | Rs 2.38 as on September 30,2021 and Rs 4.70 based on March 2021 Earnings after considering enhanced Equity Capital after Bonus Issues on September 8,2021 |

Computed IPO Price Range is Rs 2000 to Rs 2100

We have worked out an IPO Price Range of Rs 2000 to Rs 2200

This is based on the above offer and the revised FY 22 Disinvestment of Rs 78000 crs of which Rs 12000 crs has been achieved. Thus, implying LIC IPO size should be @ Rs 66000 crs

At Rs 2200 the Market Capitalisation of LIC is Rs 13,91,500 crs (US $ 186 b taking $=Rs 75)) putting it in the TOP 3 Listed Companies in India .Reliance Industries is the leader at Rs 16,07,858 crs (US $ 214 b) with TCS second currently at Rs 13,67,021 crs (US $ 182 b) as on Friday closing February 11,2022

Total BSE Market Capitalisation at closing on Friday, February 11,2022 was Rs 2,63,89,886 crs ( US $ 3.5 Trillion). Interestingly LIC value of its Investments in Listed Equity is @ US 140 b or near 4% of the Market Cap

Being the Market Leader, LIC Valuation is obviously much higher than Peer Group on relative Valuations of PE and PBV and is a near 2.6 Multiple of its Embedded Value

Interesting Extracts from the DRHP form part of this SCRIP STANDPOINT in the pages that follow

Cheers,

Gaurav Parikh, Managing Director

[email protected] +9820162597

Disclosure & Disclaimer

Jeena Scriptech Alpha Advisors Pvt Ltd (JSAAPL) is a SEBI Registered Entity offering Fundamental Direct Equity Research Analysis, Equity Portfolio Advisory, Training & Mentoring Services in Capital Markets

This Report is under our free access SCRIP STANDPOINT Module.It is for the personal information of the recipient/reader. We are not soliciting any action based upon it. This report is not to be construed as an offer to sell or the solicitation of an offer to buy any security in any jurisdiction. It is our Viewpoint for general information purposes only. It does not take into account the particular investment objectives, financial situations, or needs of individuals & other entities .We have reviewed the report, and in so far as it includes current or historical information, it is believed to be reliable though its accuracy or completeness cannot be guaranteed. Neither JSAAPL, nor any person connected with it, accepts any liability arising from the use of this document. The recipients of this material should rely on their own investigations and take their own professional advice. Opinions expressed are our current opinions as of the date appearing on this material only. No part of this material may be duplicated in any form and/or redistributed without JSAAPL’s prior written consent.In case you require any clarification or have any concern, kindly write to us at: [email protected]

|